Adjustable Rate Mortgage

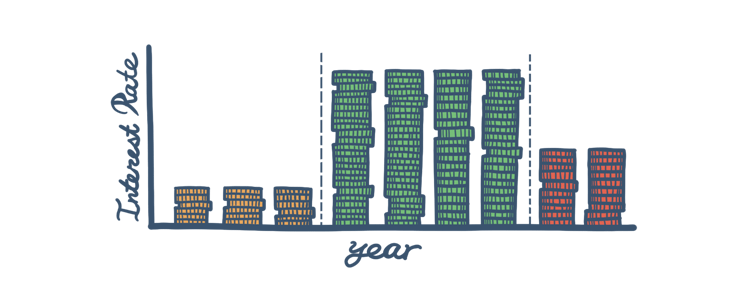

An adjustable-rate mortgage (ARM) has an interest rate that changes periodically through the life of the loan. ARMs come with an introductory period with a low, fixed rate. After this initial period, the interest rate applied to the outstanding balance varies based on the market index.

How the FHA ARM Works

The interest rate you get after the initial period is over is based on an index and your lender’s margin (which should be disclosed when you apply for the loan). The new interest rate is calculated by adding the margin to the index. As the index figure changes, so will your interest rate. The FHA accepts market index figures of the Constant Maturity Treasury (CMT) index or the 1-year London Interbank Offered Rate (LIBOR).

The idea of a large swing in the interest rates might make an ARM less appealing. That’s why the FHA places two types of caps, to provide a safeguard from astronomically high (or low) rates. There is an annual cap, which limits the points your interest rate can change year to year, and a “life-of-the-loan” cap that restricts the amount it can vary for the entire term of the loan.

FHA's ARM

The FHA has a few adjustable-rate mortgage options that can suit the needs of many borrowers. It offers a standard 1-year ARM and four "hybrid" ARM products, which have an initial interest rate that is fixed for the first 3, 5, 7, or 10 years. After that initial period, the interest rate adjusts annually.

The Pros

Choosing to finance a home with an ARM can work extremely well for some borrowers for a few reasons.

- Borrowers who intend to move and sell their home within a few years can take advantage of the low interest rates that come with the initial period of an adjustable-rate mortgage.

- Many homebuyers use the introductory period to save and budget for the future.

- Some borrowers may be expecting a significant increase in their income.

The Cons

It’s important to remember the downsides that come with the uncertainty of ARMs in order to make the best decision.

- There is always the chance that the index can go up drastically and your interest rate can skyrocket.

- When there is an uncertainty of how much you’ll be spending on monthly mortgage payments, budgeting isn’t as easy to do.

FHA Loan Articles

October 30, 2021The FHA Rehabilitation Loan program allows lenders to cover the purchase or refinance, as well as the rehabilitation of the home, as part of a single mortgage. This loan can be used to finance a property that is at least one year old with a total cost of repairs amounting to at least $5,000

October 16, 2021The FHA’s aim is to make homeownership more affordable and accessible for Americans, and it has been doing so for decades. It insures home loans made by FHA-approved lenders so borrowers can purchase single-family and multi-family homes in the US and its territories.

September 20, 2021A down payment is an upfront installment or part of a larger amount paid on a purchase. The remainder is paid off in separate installments, usually with interest, as part of a loan. The down payment represents your initial ownership stake in the home you continue to make payments on.

September 2, 2021For many first-time home buyers, the FHA loan is a popular option. With its lenient credit and income requirements, it appeals to young borrowers who don’t have an extensive credit history, or enough money saved up for a down payment.

July 30, 2021The FHA Streamline Refinance allows mortgage holders to refinance their home loan without going through the process of second appraisal. Since this is a step that was completed with the first FHA mortgage, the FHA waives it for the refinance

July 14, 2021Making the decision to buy a house is a big one, followed by the choice of which house to buy. The next biggest decision you make is going to be the type of home loan you need to go through with the purchase. One option for financing your home is an FHA loan.