FHA Reverse Mortgage

Reverse mortgages have become increasingly popular with seniors who have equity in their homes and want to supplement their income. The FHA insures a reverse mortgage called the Home Equity Conversion Mortgage (HECM) that is available through FHA-approved lenders. These loans are available to homeowners aged 62 or older who have paid off or paid down a considerable amount of their mortgage.

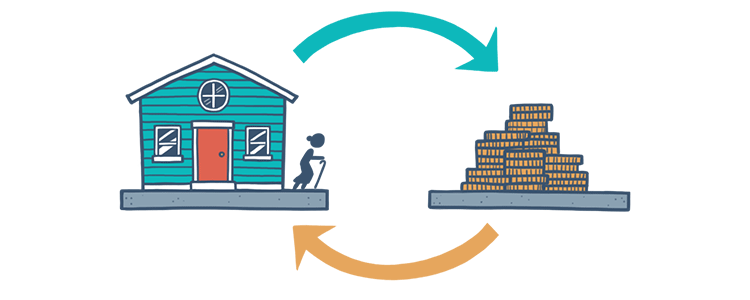

How it Works

The FHA’s reverse mortgage program lets you to withdraw a portion of your home's equity. The amount that will be available for withdrawal varies by borrower. It depends on the age of the youngest borrower or eligible non-borrowing spouse, the current interest rate, and lesser of the appraised value or the HECM FHA mortgage limit or the sales price.

Funds can be received in the following formats:

- Equal monthly payments for the rest of your life.

- Equal monthly payment for an agreed period.

- A line of credit, though there are caps on the size of some lump-sum withdrawals.

The principal and interest are due for repayment when the home is sold, or when the borrower dies. FHA mortgage insurance is also required with such a loan, which can be financed as part of the loan as well.

Who's it For?

To be eligible for an FHA reverse mortgage, you need to be compliant with the eligibility criteria.

- You must be 62 years or older.

- You must own the home outright or paid-down a considerable amount.

- You must occupy the home as your primary residence.

- You must remain current on property taxes, homeowner’s insurance, and other mandatory obligations.

- You must participate in a consumer information session led by a HUD-approved counselor.

- You must maintain your property and keep it in good working condition.

- You must complete a consumer information session given by a HUD-approved HECM counselor.

There are also some property guidelines your house must fall under to be eligible for an HECM. It must be a single-family home or 2- to 4-unit home with one unit occupied by the borrower, a HUD-approved condominium project, or a manufactured home that meets FHA requirements.

FHA Loan Articles

November 22, 2023In the last days of November 2023, mortgage loan rates flirted with the 8% range but have since backed away, showing small but continued improvement. What does this mean for house hunters considering their options to become homeowners soon?

November 4, 2023In May 2023, USA Today published some facts and figures about the state of the housing market in America. If you are weighing your options for an FHA mortgage and trying to decide if it’s cheaper to buy or rent, your zip code may have a lot to do with the answers you get.

October 14, 2023FHA loan limits serve as a crucial mechanism to balance financial sustainability, regional variations in housing costs, and the agency's mission to promote homeownership, particularly for those with limited financial resources.

September 25, 2023Mortgage rates are hitting prospective homeowners hard this year and are approaching 8%, a rate that didn't seem very likely last winter. With so many people priced out of the market by the combination of high rates and a dwindling supply of homes.

September 19, 2023The FHA Handbook serves as a crucial resource for mortgage lenders, appraisers, underwriters, and other professionals involved in the origination and servicing of FHA-insured home loans. It outlines the policies and requirements for FHA-insured mortgages.

September 13, 2023FHA rehab loans are a specialized type of mortgage loan offered by the Federal Housing Administration that allows borrowers to finance both the purchase or refinance of a home and the cost of needed repairs.