FHA Refinance Loans

There are a number of reasons that homeowners decide to refinance their homes. You might want to take advantage of low interest rates to decrease your monthly mortgage payments. Or it might be you simply want to put your home equity to work by making upgrades. Whatever the reason, there's likely to be a suitable FHA Refinance option available that works with your goals.

The FHA offers a "streamlined" refinancing option that allows current FHA borrowers to reduce the interest rate on their home loans quickly and oftentimes without an appraisal. FHA Streamline Refinances cut down on the amount of paperwork that must be completed by lenders saving valuable time and money.

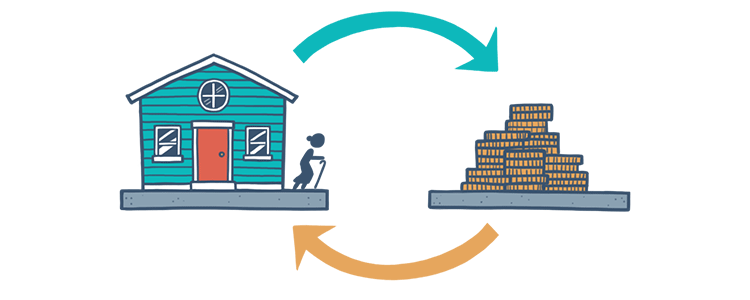

A cash-out refinance lets existing homeowners to use the equity they've already accumulated on their home. To be eligible for an FHA Cash-Out Refinance, FHA borrowers must have at least 20% equity in the property based on a new appraisal.

A Simple Refinance allows a homeowner lower the interest rate on their current FHA loan, whether it's a fixed-rate loan or an ARM. The refinance is straightforward, requiring a credit qualification, income, and assets to ensure the borrower meets the new loan requirements.

The FHA 203(k) loan lets you refinance your home and use the cash funds to make repairs and upgrades to it, or to "rehabilitate" it. The FHA's Rehabilitation Loan can also be used to finance the purchase of an older, "fixer-upper" house at a low price.

The FHA's Home Equity Conversion Mortgage, commonly known as a reverse mortgage, is for homeowners above the age of 62 who are looking to use some of the equity they've amassed on their home. This loan is not repaid until the home is sold or the borrower dies.

FHA Loan Articles

November 22, 2023In the last days of November 2023, mortgage loan rates flirted with the 8% range but have since backed away, showing small but continued improvement. What does this mean for house hunters considering their options to become homeowners soon?

November 4, 2023In May 2023, USA Today published some facts and figures about the state of the housing market in America. If you are weighing your options for an FHA mortgage and trying to decide if it’s cheaper to buy or rent, your zip code may have a lot to do with the answers you get.

October 14, 2023FHA loan limits serve as a crucial mechanism to balance financial sustainability, regional variations in housing costs, and the agency's mission to promote homeownership, particularly for those with limited financial resources.

September 25, 2023Mortgage rates are hitting prospective homeowners hard this year and are approaching 8%, a rate that didn't seem very likely last winter. With so many people priced out of the market by the combination of high rates and a dwindling supply of homes.

September 19, 2023The FHA Handbook serves as a crucial resource for mortgage lenders, appraisers, underwriters, and other professionals involved in the origination and servicing of FHA-insured home loans. It outlines the policies and requirements for FHA-insured mortgages.

September 13, 2023FHA rehab loans are a specialized type of mortgage loan offered by the Federal Housing Administration that allows borrowers to finance both the purchase or refinance of a home and the cost of needed repairs.