What to Know About the FHA Handbook

September 19, 2023

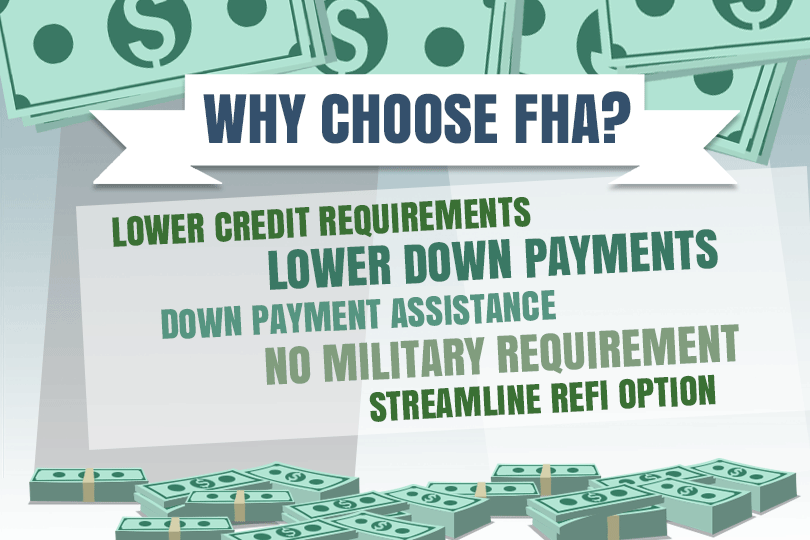

The FHA Handbook outlines the policies and requirements for FHA-insured mortgages, which are popular among first-time homebuyers and borrowers with lower credit scores or smaller down payments. It provides detailed instructions and guidelines on various aspects of the FHA loan program, including eligibility criteria, underwriting standards, property appraisal requirements, and mortgage insurance.

Key components covered in the FHA Handbook include:

Eligibility Requirements

The handbook explains who is eligible for an FHA loan, including minimum credit score requirements, debt-to-income ratios, and down payment guidelines.

Property Standards

It describes the property requirements that must be met for a home to qualify for FHA financing. This includes guidelines for the condition and safety of the property.

Appraisal Guidelines

The FHA Handbook outlines the specific requirements for property appraisals, ensuring that the property's value is accurately determined.

Credit Underwriting

It provides guidance on how lenders should assess the creditworthiness of FHA loan applicants, including requirements for handling credit issues and disputes.

Mortgage Insurance

Details on FHA mortgage insurance premiums, including both upfront and annual premiums, are included.

Closing and Settlement Costs

Information on allowable and non-allowable fees and costs for the borrower, as well as the seller's contributions.

Loan Origination and Processing

Guidelines for the processing of FHA loan applications, including required documentation and borrower verification.

Servicing and Loss Mitigation

Information on loan servicing requirements and how to handle delinquencies and foreclosures.

The FHA Handbook is periodically updated to reflect changes in FHA policies and industry best practices. Lenders and other professionals involved in FHA lending are required to adhere to the guidelines outlined in the handbook to ensure that loans meet FHA standards and qualify for FHA insurance.

------------------------------

RELATED VIDEOS:

There's a Difference Between APR and Interest Rates

Choose Your Mortgage Lender Carefully

Getting Started With Your FHA Loan Application

FHA Loan Articles

March 31, 2025Is 2025 the right year for you to consider an FHA streamline refinance? These mortgages are for those who want a lower interest rate, a lower monthly payment, or to move out of an adjustable-rate mortgage and into a fixed-rate loan. We examine some of the critical features of FHA streamline refinances.

March 27, 2025Did you know there are FHA loans that let house hunters buy multi-family properties such as duplexes and triplexes? FHA rules for these transactions is found in HUD 4000.1, including owner-occupancy, require that one unit serve as the borrower’s primary residence. Some house hunters ask why this rule exists. Some believe the rule serves as a lender risk mitigation strategy.

March 25, 2025What does it take to sell a house purchased with an FHA mortgage? Are there special rules, restricrtions, or added considerations? We examine some key questions and their answers to FHA real estate sales issues.

March 24, 2025If you are selling a home, you may need to negotiate with buyers to fund their purchases with an FHA mortgage. What do you, as a seller, need to know about FHA mortgages and how they may differ from conventional loans? We examine some common issues.

March 24, 2025How much do you really know about how FHA home loan interest rates are set and what factors influence them before your lender makes you an offer? We explore some key points about FHA loan rates, FICO scores, and debt ratios.