Adjustable Rate Mortgage

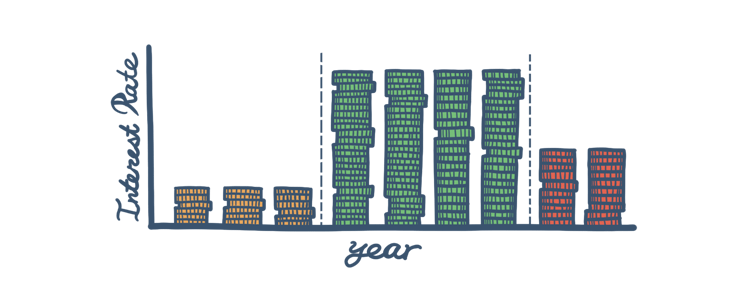

An adjustable-rate mortgage (ARM) has an interest rate that changes periodically through the life of the loan. ARMs come with an introductory period with a low, fixed rate. After this initial period, the interest rate applied to the outstanding balance varies based on the market index.

How the FHA ARM Works

The interest rate you get after the initial period is over is based on an index and your lender’s margin (which should be disclosed when you apply for the loan). The new interest rate is calculated by adding the margin to the index. As the index figure changes, so will your interest rate. The FHA accepts market index figures of the Constant Maturity Treasury (CMT) index or the 1-year London Interbank Offered Rate (LIBOR).

The idea of a large swing in the interest rates might make an ARM less appealing. That’s why the FHA places two types of caps, to provide a safeguard from astronomically high (or low) rates. There is an annual cap, which limits the points your interest rate can change year to year, and a “life-of-the-loan” cap that restricts the amount it can vary for the entire term of the loan.

FHA's ARM

The FHA has a few adjustable-rate mortgage options that can suit the needs of many borrowers. It offers a standard 1-year ARM and four "hybrid" ARM products, which have an initial interest rate that is fixed for the first 3, 5, 7, or 10 years. After that initial period, the interest rate adjusts annually.

The Pros

Choosing to finance a home with an ARM can work extremely well for some borrowers for a few reasons.

- Borrowers who intend to move and sell their home within a few years can take advantage of the low interest rates that come with the initial period of an adjustable-rate mortgage.

- Many homebuyers use the introductory period to save and budget for the future.

- Some borrowers may be expecting a significant increase in their income.

The Cons

It’s important to remember the downsides that come with the uncertainty of ARMs in order to make the best decision.

- There is always the chance that the index can go up drastically and your interest rate can skyrocket.

- When there is an uncertainty of how much you’ll be spending on monthly mortgage payments, budgeting isn’t as easy to do.

FHA Loan Articles

June 25, 2021Most first-time homebuyers decide on purchasing a home at least a year in advance, sometimes even a couple of years ahead of time. The earlier you make a decision to buy a home, the more time you have to save up for your down payment.

May 24, 2021With historically low interest rates, the mortgage industry has seen a sharp uptick in refinances. Taking advantage of the current market might be in your best interest and could lower your monthly payment significantly. Don’t forget that refinancing a mortgage comes with closing costs.

May 8, 2021With a new waiver in place, Dreamers have access to affordable FHA home loans designed for first-time homebuyers. There is no discrepancy in the FHA’s eligibility requirements when it comes to DACA status holders applying for an FHA-backed mortgage. They must meet all the same criteria.

April 30, 2021Buying a house is overwhelming to begin with. Make it a seller’s market, and buyers become even more nervous. Supply of real estate has been low for most of 2021, in part because of the Coronavirus pandemic and the historically low interest rates since 2019.

April 23, 2021No matter what kind of market you’re in, it is always best to get pre-approved before going to shop for houses. The last thing you want is to go look at homes, find the one you love, then have to wait on an approval and lose the dream home to another buyer.

April 11, 2021With the trend of falling interest rates since 2019, the number of mortgage refinances around the country has spiked and continues to rise. Borrowers with FHA loans can also capitalize on the low rates, but it may be possible to simplify the process with the FHA Streamline Refinance.