Growing Equity Mortgage

Growing Equity Mortgages (GEMs) are part of the FHA’s Section 245(a) loan type that start off with lower initial payments, and increase according to a predetermined schedule over the life of the loan. Similar to a Graduated Payment Mortgage, GEMs are a good option for potential homebuyers who expect higher earnings in the future.

How Does a GEM Work?

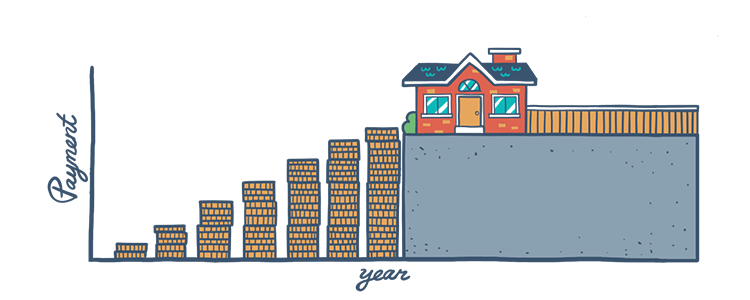

Growing Equity Mortgages allow you to purchase a home sooner than you would be able to with most other financing options. There is an introductory year during which your monthly payments are based on a 30-year, fixed-rate schedule. After this initial year ends, your payments increase annually at a fixed rate, depending on the plan that you choose.

The FHA offers five different GEM plans:

- Plan I (Code L):

1% fixed increase per year - Plan II (Code M):

2% fixed increase per year - Plan III (Code N):

3% fixed increase per year - Plan IV (Code O):

4% fixed increase per year - Plan V (Code P):

5% fixed increase per year

GEMs are popular because they can help you own your home sooner. While your introductory payments are calculated based on a 30-year mortgage model, the actual term of your loan is shorter due to the increasing annual payment rate. Your loan term should not exceed 22 years with the lowest plan of a 1% increase, and can be as short as 15 years with the 5% increase.

Every month, more and more money goes towards the principal amount, and the mortgage is paid off faster, which helps you save on interest. So instead of paying interest over 30 years, you'll pay only as long as it takes to pay off the full principal balance, which is a shorter amount of time due to the GEM guidelines.

Who's it For?

Unlike a Graduated Payment Mortgage, a GEM’s scheduled increments of monthly payments result in a shorter loan term and lower cost to the borrower, because it comes without the risk of negative amortization that can lead to an unmanageable balloon payment.

Though HUD’s 245(a) program was designed to assist low-income first-time homebuyers purchase a home sooner than they would be able to with conventional mortgages, it is open to repeat homebuyers as well. They can all take advantage of the FHA’s lenient qualification requirements such as low down payments and credit scores.

Similar to a Graduated Payment Mortgages, this type of home loan is only eligible to purchase single-family properties or condominiums that will serve as the borrower’s primary residence and not an investment property. This loan type is ideal for borrowers who expect to see a rise in their income and want to own a home sooner. However, it is also important that borrowers be completely positive of their future earning potential and job security when deciding to finance their home with a Growing Equity Mortgage.

FHA Loan Articles

October 30, 2021The FHA Rehabilitation Loan program allows lenders to cover the purchase or refinance, as well as the rehabilitation of the home, as part of a single mortgage. This loan can be used to finance a property that is at least one year old with a total cost of repairs amounting to at least $5,000

October 16, 2021The FHA’s aim is to make homeownership more affordable and accessible for Americans, and it has been doing so for decades. It insures home loans made by FHA-approved lenders so borrowers can purchase single-family and multi-family homes in the US and its territories.

September 20, 2021A down payment is an upfront installment or part of a larger amount paid on a purchase. The remainder is paid off in separate installments, usually with interest, as part of a loan. The down payment represents your initial ownership stake in the home you continue to make payments on.

September 2, 2021For many first-time home buyers, the FHA loan is a popular option. With its lenient credit and income requirements, it appeals to young borrowers who don’t have an extensive credit history, or enough money saved up for a down payment.

July 30, 2021The FHA Streamline Refinance allows mortgage holders to refinance their home loan without going through the process of second appraisal. Since this is a step that was completed with the first FHA mortgage, the FHA waives it for the refinance

July 14, 2021Making the decision to buy a house is a big one, followed by the choice of which house to buy. The next biggest decision you make is going to be the type of home loan you need to go through with the purchase. One option for financing your home is an FHA loan.