Graduated Payment Mortgage

The FHA has a particular loan available for low- to moderate-income homebuyers who expect their incomes to increase in upcoming years. The Graduated Payment Mortgage (GPM), also known as HUD's Section 245(a), is a kind of fixed-rate mortgage that starts with lower monthly payments that gradually increase based on a predefined schedule. Typically, the GPM payments increase between 7-12% annually from the initial amount until the full monthly payment amount is reached.

How Does a GPM Work?

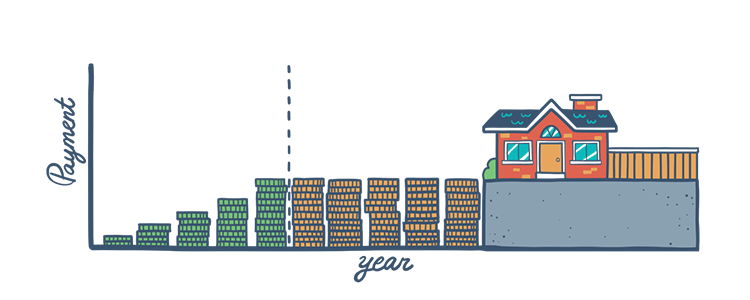

It's important to understand how the monthly mortgage payments for a graduated payment mortgage work differently than that of a regular fixed-rate loan. A graduated payment mortgage starts with smaller minimum payments, with the payment amount increasing gradually over time. The low introductory interest rates make it so more borrowers—who might not otherwise qualify—can afford the low initial payments and be eligible for the loan. Different payment plans are available with varying lengths and rate of payment increases, and some include a higher down payment as well.

The FHA offers five different GPM plans to suit borrowers' needs.

- Plan I:

Monthly mortgage payments increase 2.5% each year for 5 years - Plan II:

Monthly mortgage payments increase 5% each year for 5 years - Plan III:

Monthly mortgage payments increase 7.5% each year for 5 years - Plan IV:

Monthly mortgage payments increase 2% each year for 10 years - Plan V:

Monthly mortgage payments increase 3% each year for 10 years

Once the loan reaches the set time period of rate increase, monthly payments remain constant for the remainder of the mortgage term. Keep in mind that borrowers must make higher monthly payments toward the end of the loan as they'll begin to pay down the deferred debt.

Who's it For?

FHA's graduated payment mortgage program is available to finance single-family homes which must serve as the borrower's primary residence. The loan is ideally suited for low- to moderate-income who see their income levels increasing over the coming years. Buyers can tailor the monthly mortgage payments by picking the best plan, giving themselves the means to purchase a home sooner than they would be able to through conventional financing programs. In addition to the payment plans, GPMs come with FHA's flexible eligibility requirements, including low down payments and credit scores.

GPM borrowers should understand that over the life of the mortgage, they will pay more in interest than they would have had they chosen a mortgage with payments that remained the same over the life of the loan. While this type of loan is a great way to purchase a home earlier instead of renting, potential borrowers should also be critical and honest when assessing their future income increments and job security.

FHA Loan Articles

October 30, 2021The FHA Rehabilitation Loan program allows lenders to cover the purchase or refinance, as well as the rehabilitation of the home, as part of a single mortgage. This loan can be used to finance a property that is at least one year old with a total cost of repairs amounting to at least $5,000

October 16, 2021The FHA’s aim is to make homeownership more affordable and accessible for Americans, and it has been doing so for decades. It insures home loans made by FHA-approved lenders so borrowers can purchase single-family and multi-family homes in the US and its territories.

September 20, 2021A down payment is an upfront installment or part of a larger amount paid on a purchase. The remainder is paid off in separate installments, usually with interest, as part of a loan. The down payment represents your initial ownership stake in the home you continue to make payments on.

September 2, 2021For many first-time home buyers, the FHA loan is a popular option. With its lenient credit and income requirements, it appeals to young borrowers who don’t have an extensive credit history, or enough money saved up for a down payment.

July 30, 2021The FHA Streamline Refinance allows mortgage holders to refinance their home loan without going through the process of second appraisal. Since this is a step that was completed with the first FHA mortgage, the FHA waives it for the refinance

July 14, 2021Making the decision to buy a house is a big one, followed by the choice of which house to buy. The next biggest decision you make is going to be the type of home loan you need to go through with the purchase. One option for financing your home is an FHA loan.