FHA Loans, New Borrowers, And Credit

November 27, 2024

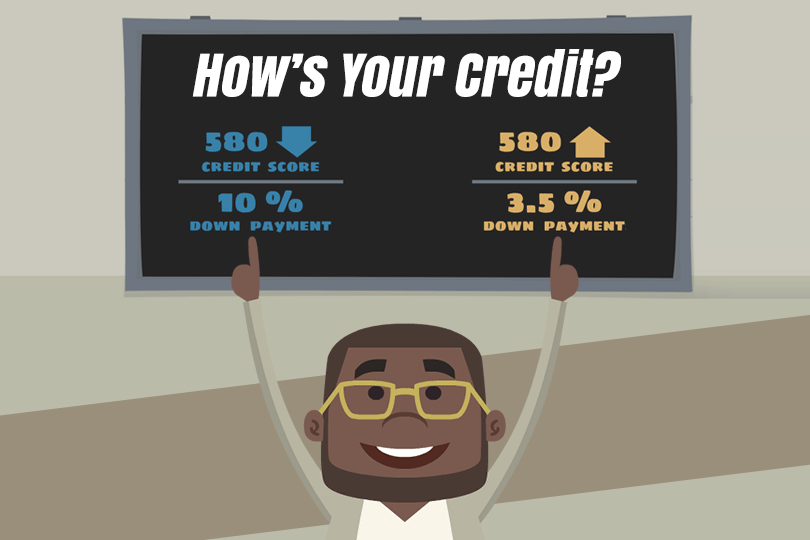

FHA Loans And Credit Scores

What follows is not financial advice. Always consult a finance or tax professional for the most current information.

While FHA loans offer more lenient credit score requirements, establishing a positive credit history is still vital in loan approval. You’ll need to know what your lender will see in your credit report long before you submit that information to them. How many credit mistakes are too many for your lender?

There is no set metric, but to understand how the lender thinks, remember that they have to justify approving your loan based on the information in your reports. Does the data in them make it easier or harder for the lender to say yes?

Lenders use credit reports to assess borrowers' creditworthiness and history of managing debt. Managing your financial obligations is a big part of loan approval. If you need to work on your credit, there are several ways to do so before a home loan application. Start working on these issues a year in advance at a minimum.

Building Credit

Several strategies exist for building credit. Secured credit cards, which require a security deposit, can help, but you will need time to build up your credit patterns with the new card.

Responsible use of a secured card can help build credit over time, as can credit-builder loans, which involve borrowing a small amount of money held in a savings account until the loan is repaid.

The activity on these loans is typically reported to credit bureaus, helping establish a credit history.

Consider becoming an authorized user on a responsible family member or friend's credit card. This, too, can help build credit since the account's payment history may be reported to credit bureaus.

Making consistent and on-time student loan payments demonstrates responsible debt management and contributes to a positive credit history. Some services allow renters to report their rent payments to credit bureaus, which can help establish a credit history.

Read Your Credit Reports

Request a free credit report from Equifax, Experian, and TransUnion. You are entitled to a free report annually to review for accuracy and identify problems.

Did you find errors or inaccuracies on your credit report? Dispute them immediately and set up credit monitoring services to track your credit score and stay informed of any changes.

FHA Loan Articles

December 4, 2024When you think about owning a farm, do you dream of vast landscapes and thriving agricultural enterprises? Or are you looking for a quaint farm-style house to live in but not necessarily to start a new farming career?

Borrowers who want to buy a farm residence are in luck with the FHA loan program, which includes options to purchase farm residences.

November 27, 2024If you are new to the home loan process, you may wonder how your loan officer will interpret your application data. How lenient is the lender with issues related to debt, credit utilization, and related factors? We examine some key points, but remember that what follows is not financial advice. Always consult a finance or tax professional for the most current information.

November 26, 2024

Thinking about buying a home? One of the first things you'll want to consider doing is filling out forms to be pre-approved for your FHA mortgage. This means a lender takes a look at your finances to figure out how much they're willing to loan you. It's a smart move, but you might be wondering: "Will applying for pre-approval hurt my credit score?"

November 25, 2024FHA mortgages include a refinance option that allows you to pull equity from your home in cash. The FHA cash-out refinance loan allows the borrower to take the difference between what remains to be paid on the home and the amount of equity built up.

The FHA loan program has some competition in this area, but how do your other government-backed refinance loan options measure up?

November 21, 2024The dream of homeownership is with some from a young age. But in an uncertain housing market, some grapple with the question: Is buying a home the right move for me?

While renting offers relocation flexibility and lower upfront costs, homeownership provides a wealth of financial and personal benefits.