What to Know About the FHA Handbook

September 19, 2023

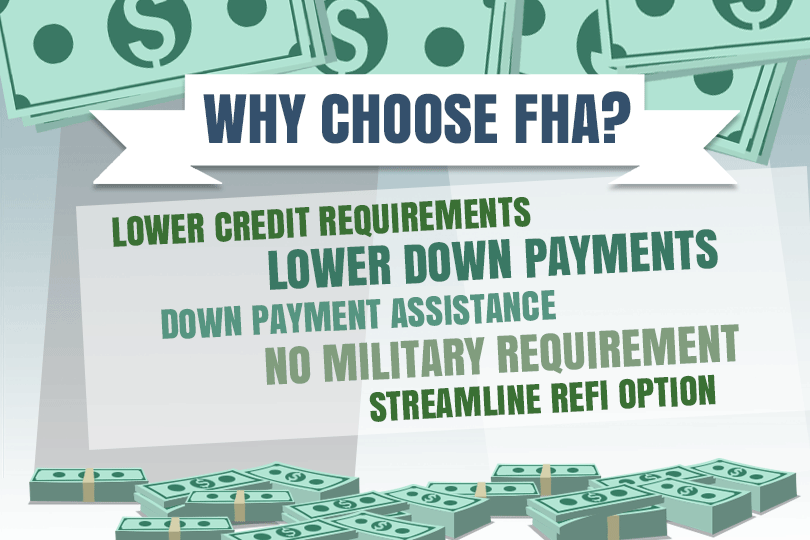

The FHA Handbook outlines the policies and requirements for FHA-insured mortgages, which are popular among first-time homebuyers and borrowers with lower credit scores or smaller down payments. It provides detailed instructions and guidelines on various aspects of the FHA loan program, including eligibility criteria, underwriting standards, property appraisal requirements, and mortgage insurance.

Key components covered in the FHA Handbook include:

Eligibility Requirements

The handbook explains who is eligible for an FHA loan, including minimum credit score requirements, debt-to-income ratios, and down payment guidelines.

Property Standards

It describes the property requirements that must be met for a home to qualify for FHA financing. This includes guidelines for the condition and safety of the property.

Appraisal Guidelines

The FHA Handbook outlines the specific requirements for property appraisals, ensuring that the property's value is accurately determined.

Credit Underwriting

It provides guidance on how lenders should assess the creditworthiness of FHA loan applicants, including requirements for handling credit issues and disputes.

Mortgage Insurance

Details on FHA mortgage insurance premiums, including both upfront and annual premiums, are included.

Closing and Settlement Costs

Information on allowable and non-allowable fees and costs for the borrower, as well as the seller's contributions.

Loan Origination and Processing

Guidelines for the processing of FHA loan applications, including required documentation and borrower verification.

Servicing and Loss Mitigation

Information on loan servicing requirements and how to handle delinquencies and foreclosures.

The FHA Handbook is periodically updated to reflect changes in FHA policies and industry best practices. Lenders and other professionals involved in FHA lending are required to adhere to the guidelines outlined in the handbook to ensure that loans meet FHA standards and qualify for FHA insurance.

------------------------------

RELATED VIDEOS:

There's a Difference Between APR and Interest Rates

Choose Your Mortgage Lender Carefully

Getting Started With Your FHA Loan Application

FHA Loan Articles

October 30, 2021The FHA Rehabilitation Loan program allows lenders to cover the purchase or refinance, as well as the rehabilitation of the home, as part of a single mortgage. This loan can be used to finance a property that is at least one year old with a total cost of repairs amounting to at least $5,000

October 16, 2021The FHA’s aim is to make homeownership more affordable and accessible for Americans, and it has been doing so for decades. It insures home loans made by FHA-approved lenders so borrowers can purchase single-family and multi-family homes in the US and its territories.

September 20, 2021A down payment is an upfront installment or part of a larger amount paid on a purchase. The remainder is paid off in separate installments, usually with interest, as part of a loan. The down payment represents your initial ownership stake in the home you continue to make payments on.

September 2, 2021For many first-time home buyers, the FHA loan is a popular option. With its lenient credit and income requirements, it appeals to young borrowers who don’t have an extensive credit history, or enough money saved up for a down payment.

August 9, 2021Many first-time homebuyers need some help understanding and navigating the ins and outs of the mortgage process, and down payments are an essential part of that. A down payment is an upfront installment made on a large purchase while the remainder is paid off with a loan.