Can I Get a No Money Down FHA Loan?

August 14, 2023

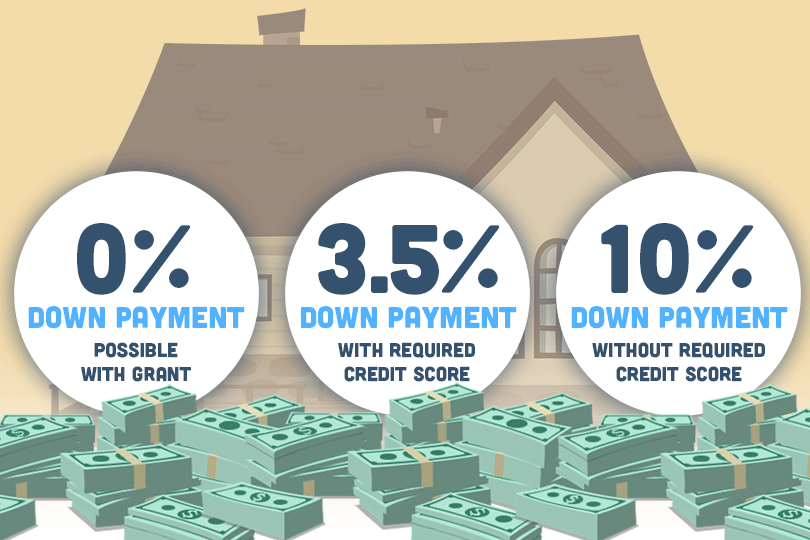

FHA loans typically require a minimum down payment of 3.5% of the purchase price of the home with the right credit score. This means that if you're buying a house for $240,000, you would need to make a down payment of at least $8,400. The down payment can come from your own funds, a gift from a family member, or a down payment assistance program. If your credit score is below the standard requirement set by you lender you may have to increase your down payment to 10% of the loan.

It's important to note that while the down payment requirement for FHA loans is relatively low, you will still need to cover closing costs, which can include fees for appraisals, inspections, title insurance, and more. These costs are separate from the down payment.

Additionally, FHA loans have mortgage insurance premiums (MIP) that borrowers are required to pay, both upfront and as part of their monthly mortgage payments. This insurance helps protect the lender in case the borrower defaults on the loan.

Please keep in mind that loan program guidelines can change over time, so it's a good idea to consult with a mortgage lender or FHA-approved lender for the most up-to-date information on FHA loan options and requirements, especially if you are considering purchasing a home today.

------------------------------

RELATED VIDEOS:

Annual Income Requirements for FHA Loans

Good Credit History Helps Get FHA Loans

Stay Informed About Your Mortgage Closing Costs

FHA Loan Articles

October 30, 2021The FHA Rehabilitation Loan program allows lenders to cover the purchase or refinance, as well as the rehabilitation of the home, as part of a single mortgage. This loan can be used to finance a property that is at least one year old with a total cost of repairs amounting to at least $5,000

October 16, 2021The FHA’s aim is to make homeownership more affordable and accessible for Americans, and it has been doing so for decades. It insures home loans made by FHA-approved lenders so borrowers can purchase single-family and multi-family homes in the US and its territories.

September 20, 2021A down payment is an upfront installment or part of a larger amount paid on a purchase. The remainder is paid off in separate installments, usually with interest, as part of a loan. The down payment represents your initial ownership stake in the home you continue to make payments on.

September 2, 2021For many first-time home buyers, the FHA loan is a popular option. With its lenient credit and income requirements, it appeals to young borrowers who don’t have an extensive credit history, or enough money saved up for a down payment.

August 9, 2021Many first-time homebuyers need some help understanding and navigating the ins and outs of the mortgage process, and down payments are an essential part of that. A down payment is an upfront installment made on a large purchase while the remainder is paid off with a loan.