FHA 203(k) Rehab Loans

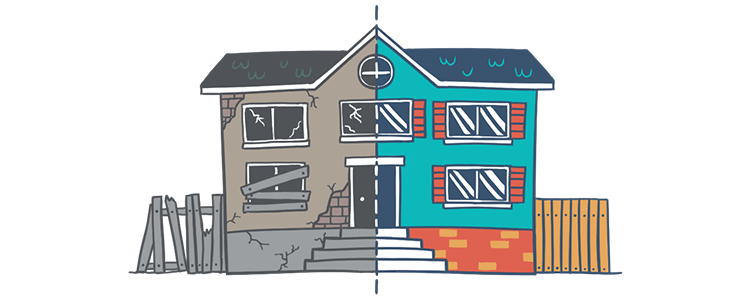

You might be one of the many Americans who decide to buy a “fixer-upper” home. Maybe it needs a whole new kitchen or the flooring needs to be redone. Whatever it is, you might be worried about financing the repairs as well as purchase for your new home. The FHA’s Section 203(k), or Rehabilitation Loan, helps both borrowers and lenders by insuring a single mortgage that covers both the purchase/refinance and rehabilitation of a property.

How it Works

Buying a home in need of considerable "rehabilitation" can be stressful when you’re not sure how to pay for it. Initially, it used to mean a complicated and expensive process, with high interest rates, short repayment terms and a balloon payment.

The FHA Rehabilitation Loan program allows lenders to cover the purchase or refinance, as well as the rehabilitation of the home, as part of a single mortgage. This loan can be used to finance a property that is at least one year old. A part of the money goes toward paying the seller—on in the case of a refinance, it pays off the existing mortgage—with the rest placed in an escrow account, disbursed as rehabilitation goes on.

To qualify for an FHA Rehabilitation Loan, the FHA requires that the total cost of repairs amount to at least $5,000. However, FHA Loan Limits still apply, so the total value of the property must fall within the lending limits for that area. With Rehabilitation Loans, the property value is determined by whichever is less:

- The home’s value before rehabilitation plus the calculated cost of repairs, or

- 110% of the appraised value of the property after repairs.

Keep in mind that the FHA Rehabilitation Loan comes with all of the flexible borrower guidelines that the FHA offers on its other mortgage and refinance programs. However, there are some additional fees that lenders can charge, such as a supplemental origination fee, fees to cover the preparation of architectural documents, and a higher appraisal fee.

Eligible Rehabilitation

FHA’s Section 203(k) insurance can cover anything from minor repairs (as long as they exceed $5000 in cost) to virtual reconstruction (a property that has been demolished as part of rehabilitation is eligible, as long as the existing foundation system is in place). According to HUD, the types of improvements that borrowers can make on their home with an FHA Rehabilitation Loan include:

- Structural alterations and reconstruction.

- Modernization and improvements to the home's function.

- Elimination of health and safety hazards.

- Changes that improve appearance and eliminate obsolescence.

- Reconditioning or replacing plumbing; installing a well and/or septic system.

- Adding or replacing roofing, gutters, and downspouts.

- Adding or replacing floors and/or floor treatments.

- Major landscape work and site improvements.

- Enhancing accessibility for a disabled person.

- Making energy conservation improvements.

FHA Loan Articles

November 2, 2021Interest rates started to decline in 2019 and still seem considerably low. The average rate for a 30-year, fixed rate home loan has fallen from 4.94% in November 2018 to 3.13% in October 2021. A point drop in your interest rate could translate to huge savings with each monthly payment

October 30, 2021The FHA Rehabilitation Loan program allows lenders to cover the purchase or refinance, as well as the rehabilitation of the home, as part of a single mortgage. This loan can be used to finance a property that is at least one year old with a total cost of repairs amounting to at least $5,000

July 30, 2021The FHA Streamline Refinance allows mortgage holders to refinance their home loan without going through the process of second appraisal. Since this is a step that was completed with the first FHA mortgage, the FHA waives it for the refinance

July 14, 2021Making the decision to buy a house is a big one, followed by the choice of which house to buy. The next biggest decision you make is going to be the type of home loan you need to go through with the purchase. One option for financing your home is an FHA loan.

May 24, 2021With historically low interest rates, the mortgage industry has seen a sharp uptick in refinances. Taking advantage of the current market might be in your best interest and could lower your monthly payment significantly. Don’t forget that refinancing a mortgage comes with closing costs.

April 11, 2021With the trend of falling interest rates since 2019, the number of mortgage refinances around the country has spiked and continues to rise. Borrowers with FHA loans can also capitalize on the low rates, but it may be possible to simplify the process with the FHA Streamline Refinance.