FHA Refinance Loans

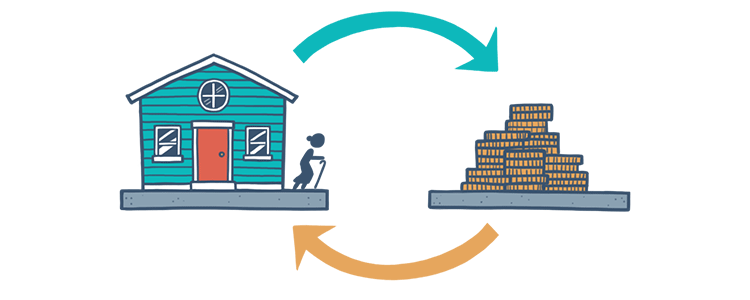

There are a number of reasons that homeowners decide to refinance their homes. You might want to take advantage of low interest rates to decrease your monthly mortgage payments. Or it might be you simply want to put your home equity to work by making upgrades. Whatever the reason, there's likely to be a suitable FHA Refinance option available that works with your goals.

The FHA offers a "streamlined" refinancing option that allows current FHA borrowers to reduce the interest rate on their home loans quickly and oftentimes without an appraisal. FHA Streamline Refinances cut down on the amount of paperwork that must be completed by lenders saving valuable time and money.

A cash-out refinance lets existing homeowners to use the equity they've already accumulated on their home. To be eligible for an FHA Cash-Out Refinance, FHA borrowers must have at least 20% equity in the property based on a new appraisal.

A Simple Refinance allows a homeowner lower the interest rate on their current FHA loan, whether it's a fixed-rate loan or an ARM. The refinance is straightforward, requiring a credit qualification, income, and assets to ensure the borrower meets the new loan requirements.

The FHA 203(k) loan lets you refinance your home and use the cash funds to make repairs and upgrades to it, or to "rehabilitate" it. The FHA's Rehabilitation Loan can also be used to finance the purchase of an older, "fixer-upper" house at a low price.

The FHA's Home Equity Conversion Mortgage, commonly known as a reverse mortgage, is for homeowners above the age of 62 who are looking to use some of the equity they've amassed on their home. This loan is not repaid until the home is sold or the borrower dies.

FHA Loan Articles

January 27, 2023Before you get ready to commit to a home loan application, it’s good to review your circumstances and ask a few basic questions about your loan, your plans, and the home itself. Believe it or not, knowing what type of home loan you need is an important step.

January 10, 2023When getting ready to shop for a home loan, it's worth taking a look at your credit report. Your credit score is a big factor when lenders take a look at your loan application, and it plays a huge role in the interest rate you get.

November 8, 2022The fact is that repairs and renovations to your home cost a lot of money. Luckily, the FHA has an option for those with fixer-uppers on their hands. The FHA 203(k) Rehabilitation Mortgages allows borrowers to finance the funds for renovations to a home.

May 7, 2022The appraisal process is a very important part of buying a home. When you are budgeting and planning for your loan, you may want to set aside some extra funds in case there are corrections required as the result of an appraisal.

March 30, 2022Once you’ve decided that you’ll be purchasing a home, one of the first questions you need to ask yourself is what kind of mortgage you’ll be using to finance it. When it comes to shopping for a home loan, there are a number of options to consider.

March 3, 2022Savvy homeowners make it a point to monitor interest rates so they can take advantage of a drop. Many choose to refinance their mortgages to capitalize on falling rates and lower their monthly payments and save on interest.