FHA Refinance Loans

There are a number of reasons that homeowners decide to refinance their homes. You might want to take advantage of low interest rates to decrease your monthly mortgage payments. Or it might be you simply want to put your home equity to work by making upgrades. Whatever the reason, there's likely to be a suitable FHA Refinance option available that works with your goals.

The FHA offers a "streamlined" refinancing option that allows current FHA borrowers to reduce the interest rate on their home loans quickly and oftentimes without an appraisal. FHA Streamline Refinances cut down on the amount of paperwork that must be completed by lenders saving valuable time and money.

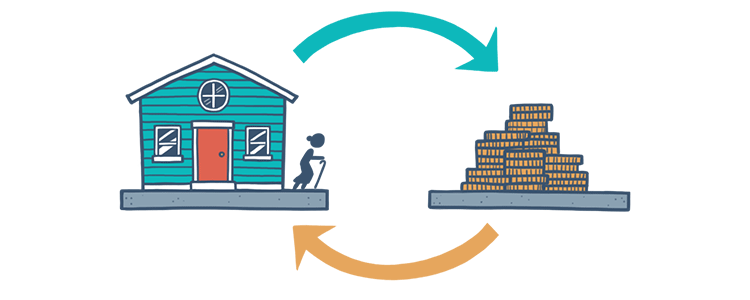

A cash-out refinance lets existing homeowners to use the equity they've already accumulated on their home. To be eligible for an FHA Cash-Out Refinance, FHA borrowers must have at least 20% equity in the property based on a new appraisal.

A Simple Refinance allows a homeowner lower the interest rate on their current FHA loan, whether it's a fixed-rate loan or an ARM. The refinance is straightforward, requiring a credit qualification, income, and assets to ensure the borrower meets the new loan requirements.

The FHA 203(k) loan lets you refinance your home and use the cash funds to make repairs and upgrades to it, or to "rehabilitate" it. The FHA's Rehabilitation Loan can also be used to finance the purchase of an older, "fixer-upper" house at a low price.

The FHA's Home Equity Conversion Mortgage, commonly known as a reverse mortgage, is for homeowners above the age of 62 who are looking to use some of the equity they've amassed on their home. This loan is not repaid until the home is sold or the borrower dies.

FHA Loan Articles

August 10, 2023FHA loans have specific rules and requirements for borrowers who have filed for bankruptcy. The guidelines can change over time, so it's essential to consult with a qualified lender or FHA-approved counselor for the most up-to-date information.

August 3, 2023FHA loans are primarily designed to help individuals and families purchase homes for use as their primary residences. Rules for these loans generally discourage their use for investment properties or rentals. However, there are exceptions that come with strict rules.

July 29, 2023One crucial aspect of FHA loans that borrowers need to understand thoroughly is debt ratios. In this article, we look at how they can impact your ability to secure financing for your dream home. Debt ratios help lenders understand a borrower's creditworthiness and any risks associated with the loan.

July 21, 2023Investing in a multi-unit property can be an excellent way to build wealth through rental income and property appreciation. FHA multi-unit property loans make this opportunity more accessible to a broader range of individuals. You must occupy a unit as your primary residence within 60 days of closing the loan.

July 2, 2023Buying a home is a significant milestone in life, and for many, it's a dream come true. However, the path to homeownership can be fraught with challenges, and one of the most concerning issues can be high FHA loan interest rates.

May 3, 2023Sometimes when buying a home there may be a question of surplus or excess land. You likely won’t face this issue when buying a condo unit, but for other types of purchases, this may be an important factor in the appraisal process.