Why Some FHA Loans Are Denied

December 17, 2024

While financial factors like credit score and debt-to-income ratio are key to loan approval, other non-financial aspects can also cause a denial.

Property Condition and Appraisal Concerns

The FHA has minimum property standards for homes being financed. Lenders must confirm the property meets these standards before approving the loan.

An FHA-approved appraiser will assess the property's condition, including its structure, foundation, electrical systems, plumbing, and overall safety. If the appraisal reveals issues, such as a damaged roof, faulty wiring, or a cracked foundation, the FHA may require repairs before approving the loan.

Appraisal Value Versus Sale Price

The appraisal also determines the property's fair market value. If the appraisal value is lower than the sale price, it can create an obstacle.

The FHA will only insure a loan for the appraised value, not the agreed-upon sale price. This protects both the borrower and the FHA from overpaying for a property.

In such cases, the buyer may need to renegotiate the price with the seller, make a larger down payment, or even walk away from the deal.

Is The Title Clear?

A clear title is essential for all real estate loans, and FHA loans are no exception. The title search examines the property's ownership history to ensure no liens, judgments, or other issues could affect the buyer's ownership rights.

Issues like unresolved boundary disputes, unknown easements, or outstanding taxes can complicate the title and lead to loan denial.

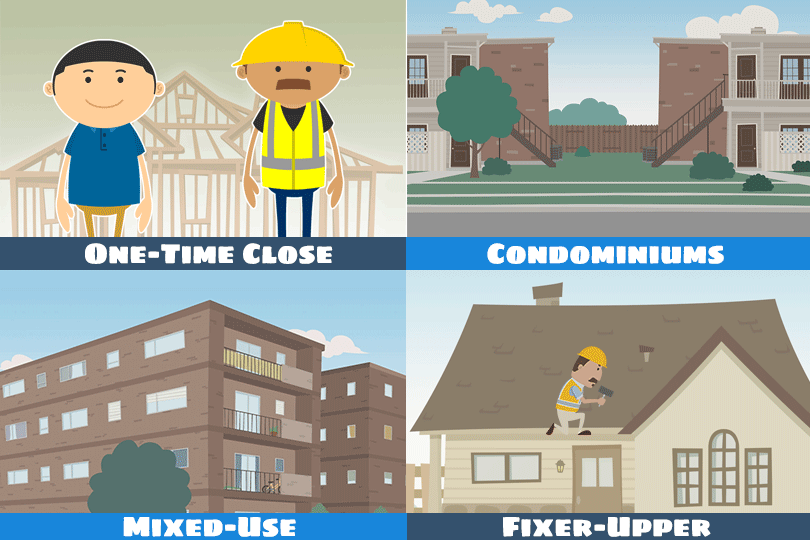

Property Types

While the FHA insures many property types, certain types are ineligible for FHA financing. These may include properties in certain coastal barrier areas, those deemed uninhabitable, or those located in areas with environmental hazards.

Additionally, homes not intended for year-round owner occupancy (such as vacation homes or investment properties) may not qualify for FHA loans.

Documentation Matters

Providing complete and accurate documentation is vital for loan approval. The lender will require various documents, including income verification, tax returns, bank statements, and employment history.

Incomplete or inconsistent documentation can raise red flags and lead to delays or denials. Borrowers must be prepared to provide all necessary paperwork and ensure accuracy promptly.

FHA Housing Counseling Options

Are you worried about your ability to qualify for an FHA mortgage? The FHA recognizes that navigating the home-buying process can be complex. The FHA offers housing counseling services to assist borrowers through a network of HUD-approved counseling agencies. These agencies can help inform you about various aspects of homeownership, including:

Pre-purchase Counseling: This counseling helps potential homebuyers understand homeownership's responsibilities and financial implications. It covers budgeting, credit, shopping for a home, and choosing the right mortgage.

Foreclosure Prevention Counseling: If a homeowner is facing financial difficulties and struggling to make mortgage payments, foreclosure prevention counseling can help. Counselors can assist with developing a budget, negotiating with lenders, and exploring options to avoid foreclosure.

These FHA housing counseling services are typically free or low-cost and can be useful resources for borrowers at any stage of the home-buying process.

FHA Loan Articles

December 17, 2024The Federal Housing Administration provides mortgage insurance on loans made by FHA-approved lenders, making homeownership more attainable for those who might not qualify for conventional loans.

While financial factors like credit score and debt-to-income ratio are key to loan approval, other non-financial aspects can also cause a denial.

December 11, 2024FHA loans, insured by the Federal Housing Administration, are a popular choice for many homebuyers, especially those who need a lower downpayment or more forgiving credit qualifying requirements. FHA loans are primarily intended for primary residences—homes that borrowers will occupy as their main dwelling.

December 10, 2024The FHA announced increased loan limits for 2025, providing those seeking FHA-insured mortgages after January 1st with increased purchasing power. In this article, we explore the key aspects of these limits and their implications for your homeownership goals.

When you are approved for an FHA-insured loan, the FHA guarantees a portion of the loan to the lender, lowering lender risk...

December 9, 2024The Federal Housing Administration (FHA) helps people buy homes, especially those buying for the first time or who might not have perfect credit. In 2025, there is good news for FHA borrowers. FHA home loan limits are going up.

In most places, the FHA loan limit for a single-family home in 2025 is $524,225. This is more than it was in 2024. However, in expensive areas, where houses cost more, the limit can be as high as $1,209,750.

December 5, 2024The Federal Housing Administration (FHA) has some ground rules regarding cash-out refinances. These rules are designed to protect both you and the lender, ensuring you have enough ownership of your home and reducing the risk of foreclosure. How long must you own your home before you can apply for FHA cash-out refinancing?