FHA Adjustable Rate Mortgages in 2021

February 21, 2021

The Index Changes

Lenders use a specific market index off of which an ARM’s interest rates are based. Until recently, most financial institutions, including the FHA, were using the London Inter-bank Offered Rate (LIBOR), but it was decided that effective January 3, 2022, the mortgage industry will put aside LIBOR and adopt the Secured Overnight Funding Rate (SOFR). The U.S. Federal Reserve Board and New York Federal Reserve are set to oversee the transition from LIBOR to SOFR, and have recommended that most new ARMs use SOFR instead of LIBOR beginning in September, 2020.

Why Does This Matter?

To understand why this change matters, you must know how an ARM works. The interest rate you get with an ARM is based on an index and a margin (which is disclosed when you apply for the loan). Your adjustable rate is calculated by adding the loan margin to the index, so as the index figure changes, so will your interest rate.

With the implementation of a new index, the changing rates of ARMs may start to look different. While both LIBOR and SOFR are used to measure the cost of short-term borrowing, the indexes measure that cost differently. Greg McBride, chief financial analyst at Bankrate states that, “SOFR is based on actual market transactions whereas LIBOR was determined by what various banks would charge each other to borrow on an overnight basis.” When it became clear that certain banks were able to manipulate the LIBOR rate, SOFR was created to be a more accurate and reliable index that is less susceptible to such manipulation.

While the majority of borrowers and loan applicants will not be affected by the new mandate, those with adjustable- rate mortgages, a home equity loan, or a reverse mortgage might see changes to their loan depending on how it is indexed.

McBride states that ARMS based on LIBOR will no longer be purchased by Fannie Mae and Freddie Mac. "SOFR is rapidly replacing it. Treasury-indexed ARMs are unaffected.”

Next Steps

It is important for borrowers to be in the know, and stay on top changes in their interest rate. While it is expected that the changes will relatively minor, mortgage holders with an ARM should contact their loan servicers to see which index their mortgage is based on, to avoid being caught off guard with the next adjustment. If the loan is tied to LIBOR, lenders can help identify when it will switch to SOFR and what that change could mean for the particular ARM.

------------------------------

RELATED VIDEOS:

Disclosures Give Transparency to Borrowers

Understanding the Purpose of Your Mortgage Down Payment

Putting Money Into Your Escrow Account

FHA Loan Articles

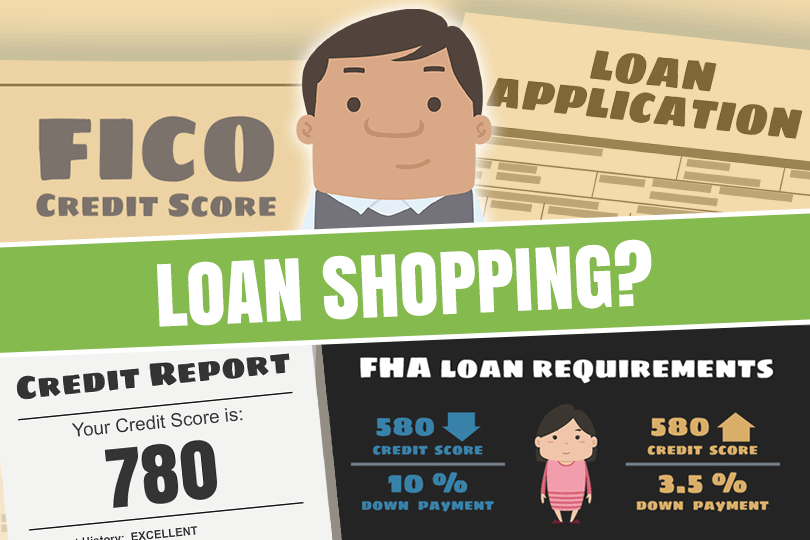

August 14, 2023FHA loans typically require a minimum down payment of 3.5% of the purchase price of the home with the right credit score. This means that if you're buying a house for $240,000, you would need to make a down payment of at least $8,400.

August 10, 2023FHA loans have specific rules and requirements for borrowers who have filed for bankruptcy. The guidelines can change over time, so it's essential to consult with a qualified lender or FHA-approved counselor for the most up-to-date information.

August 3, 2023FHA loans are primarily designed to help individuals and families purchase homes for use as their primary residences. Rules for these loans generally discourage their use for investment properties or rentals. However, there are exceptions that come with strict rules.

July 29, 2023One crucial aspect of FHA loans that borrowers need to understand thoroughly is debt ratios. In this article, we look at how they can impact your ability to secure financing for your dream home. Debt ratios help lenders understand a borrower's creditworthiness and any risks associated with the loan.

July 21, 2023Investing in a multi-unit property can be an excellent way to build wealth through rental income and property appreciation. FHA multi-unit property loans make this opportunity more accessible to a broader range of individuals. You must occupy a unit as your primary residence within 60 days of closing the loan.