Can I Get a No Money Down FHA Loan?

August 14, 2023

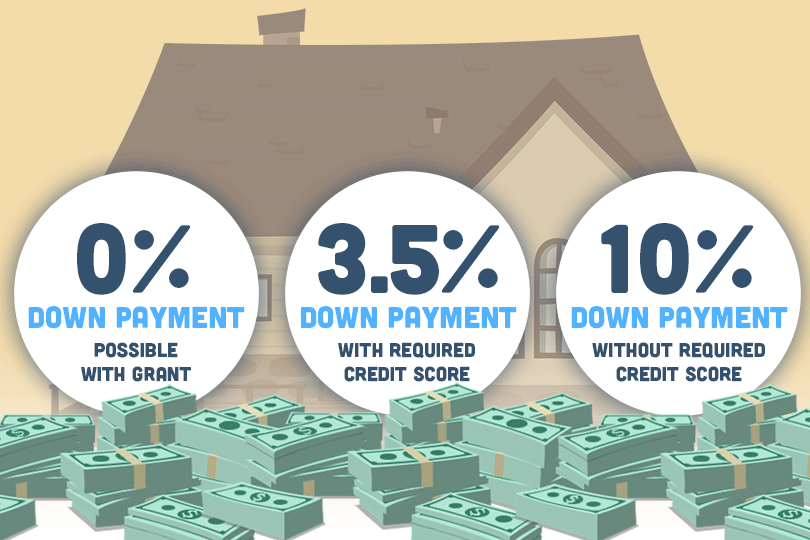

FHA loans typically require a minimum down payment of 3.5% of the purchase price of the home with the right credit score. This means that if you're buying a house for $240,000, you would need to make a down payment of at least $8,400. The down payment can come from your own funds, a gift from a family member, or a down payment assistance program. If your credit score is below the standard requirement set by you lender you may have to increase your down payment to 10% of the loan.

It's important to note that while the down payment requirement for FHA loans is relatively low, you will still need to cover closing costs, which can include fees for appraisals, inspections, title insurance, and more. These costs are separate from the down payment.

Additionally, FHA loans have mortgage insurance premiums (MIP) that borrowers are required to pay, both upfront and as part of their monthly mortgage payments. This insurance helps protect the lender in case the borrower defaults on the loan.

Please keep in mind that loan program guidelines can change over time, so it's a good idea to consult with a mortgage lender or FHA-approved lender for the most up-to-date information on FHA loan options and requirements, especially if you are considering purchasing a home today.

------------------------------

RELATED VIDEOS:

Annual Income Requirements for FHA Loans

Good Credit History Helps Get FHA Loans

Stay Informed About Your Mortgage Closing Costs

FHA Loan Articles

November 20, 2024Refinancing your mortgage offers a way to cash in on your home equity, potentially reduce your interest rate, or modify your loan term. Borrowers ready to consider have options including FHA loans and conventional loans.

While both provide avenues for refinancing, each loan type may be best for specific needs and financial circumstances. What are the differences between FHA and conventional refinance options?

November 14, 2024The home you want to buy might seem perfect, or it may have a few flaws that are acceptable in the grand scheme of things. But what about issues you can’t spot just by walking through the property a few times? A home inspection provides an unbiased, expert assessment of the property's condition, uncovering potential issues that might not be noticeable to the untrained observer.

November 12, 2024Escrow is an important feature of most typical FHA loans. An escrow account is a third-party account where borrowers deposit funds designated for property taxes and other uses. Requirements to use escrow accounts typically stems from a need to protect all parties involved in the transaction

November 2, 2024When it’s time to consider buying a home, the Federal Housing Administration (FHA) offers two popular options. One is the traditional FHA purchase loan many use to buy a house in the suburbs. But not everyone wants to buy an existing property. Some want more control over the design and configuration of the home.

The other FHA construction loan option, the one-time close mortgage, comes in here. This option is for those who want to approve floor plans, have a say in the types of materials used to build the home and choose its features.

October 31, 2024When buying a home for the first time, it helps to know how long the process can take. How do you know if your appraisal report is delayed if you don’t know how long the FHA allows for the process to be completed? How long does it take to get from the final offer to closing day? A “typical” FHA loan process may take up to 45 days from start to finish. Several factors can influence this timeline.