Understanding FHA Loan Debt Ratios

July 29, 2023

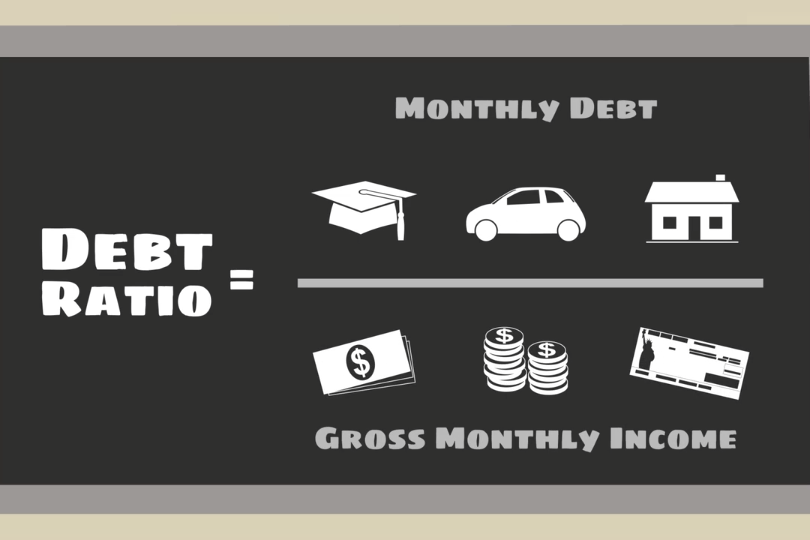

FHA loan debt ratios are financial benchmarks that assess a borrower's ability to manage their debt and make mortgage payments on time. These ratios play a pivotal role in the FHA loan approval process, as they provide a snapshot of a borrower's financial health. Two primary debt ratios are considered when evaluating an applicant's eligibility for an FHA loan:

Front-End Ratio (Housing Ratio)

This measures the percentage of a borrower's monthly gross income that will be allocated to housing-related expenses. These expenses include mortgage principal and interest, property taxes, homeowners insurance, and mortgage insurance premiums (if applicable). FHA guidelines typically require that the housing ratio does not exceed 31% of the borrower's gross income.

Back-End Ratio (Total Debt Ratio)

This is a broader measure of a borrower's debt load. It considers not only housing-related expenses but also other monthly obligations such as car loans, credit card payments, student loans, and any other outstanding debts. The FHA generally sets a maximum allowable back-end ratio of 43% of the borrower's gross income.

To improve your back-end ratio, focus on paying down existing debts, such as credit cards and personal loans. Reducing your overall debt load can make you a more attractive candidate for an FHA loan.

Both of these ratios serve as vital tools for lenders to assess your financial health and determine your eligibility for financing. By managing your debt wisely, increasing your income, and budgeting carefully, you can improve your debt ratios and increase your chances of securing an FHA loan. Remember that while debt ratios are an essential part of the approval process, they are just one piece of the puzzle, and other factors like credit score and down payment also play a role in determining your loan eligibility.

------------------------------

RELATED VIDEOS:

Let's Talk About Home Equity

Understanding Your Loan Term

Your Home Loan is Called a Mortgage

FHA Loan Articles

December 9, 2021This wait isn’t easy when you've been shopping for a new home. But getting a home inspection is a crucial step, and not one you should consider skipping. Make sure you hire a reliable home inspector, wait for your inspection report, and watch out for these red flags.

November 2, 2021Interest rates started to decline in 2019 and still seem considerably low. The average rate for a 30-year, fixed rate home loan has fallen from 4.94% in November 2018 to 3.13% in October 2021. A point drop in your interest rate could translate to huge savings with each monthly payment

October 30, 2021The FHA Rehabilitation Loan program allows lenders to cover the purchase or refinance, as well as the rehabilitation of the home, as part of a single mortgage. This loan can be used to finance a property that is at least one year old with a total cost of repairs amounting to at least $5,000

October 16, 2021The FHA’s aim is to make homeownership more affordable and accessible for Americans, and it has been doing so for decades. It insures home loans made by FHA-approved lenders so borrowers can purchase single-family and multi-family homes in the US and its territories.

September 20, 2021A down payment is an upfront installment or part of a larger amount paid on a purchase. The remainder is paid off in separate installments, usually with interest, as part of a loan. The down payment represents your initial ownership stake in the home you continue to make payments on.