Understanding FHA Loan Debt Ratios

July 29, 2023

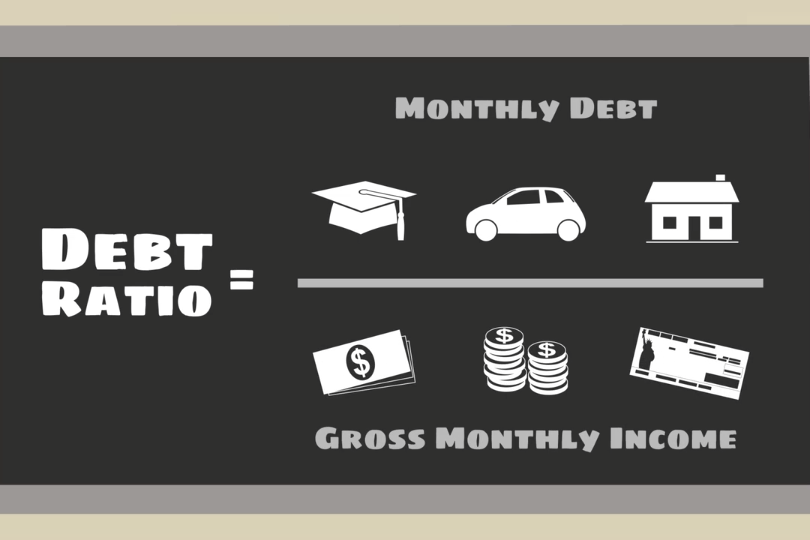

FHA loan debt ratios are financial benchmarks that assess a borrower's ability to manage their debt and make mortgage payments on time. These ratios play a pivotal role in the FHA loan approval process, as they provide a snapshot of a borrower's financial health. Two primary debt ratios are considered when evaluating an applicant's eligibility for an FHA loan:

Front-End Ratio (Housing Ratio)

This measures the percentage of a borrower's monthly gross income that will be allocated to housing-related expenses. These expenses include mortgage principal and interest, property taxes, homeowners insurance, and mortgage insurance premiums (if applicable). FHA guidelines typically require that the housing ratio does not exceed 31% of the borrower's gross income.

Back-End Ratio (Total Debt Ratio)

This is a broader measure of a borrower's debt load. It considers not only housing-related expenses but also other monthly obligations such as car loans, credit card payments, student loans, and any other outstanding debts. The FHA generally sets a maximum allowable back-end ratio of 43% of the borrower's gross income.

To improve your back-end ratio, focus on paying down existing debts, such as credit cards and personal loans. Reducing your overall debt load can make you a more attractive candidate for an FHA loan.

Both of these ratios serve as vital tools for lenders to assess your financial health and determine your eligibility for financing. By managing your debt wisely, increasing your income, and budgeting carefully, you can improve your debt ratios and increase your chances of securing an FHA loan. Remember that while debt ratios are an essential part of the approval process, they are just one piece of the puzzle, and other factors like credit score and down payment also play a role in determining your loan eligibility.

------------------------------

RELATED VIDEOS:

Let's Talk About Home Equity

Understanding Your Loan Term

Your Home Loan is Called a Mortgage

FHA Loan Articles

September 19, 2023The FHA Handbook serves as a crucial resource for mortgage lenders, appraisers, underwriters, and other professionals involved in the origination and servicing of FHA-insured home loans. It outlines the policies and requirements for FHA-insured mortgages.

September 13, 2023FHA rehab loans are a specialized type of mortgage loan offered by the Federal Housing Administration that allows borrowers to finance both the purchase or refinance of a home and the cost of needed repairs.

September 8, 2023Borrowers considering an FHA loan should be familiar with some basic loan terminology. These loans are popular among first-time homebuyers and those with lower credit scores because they often offer more flexible eligibility requirements and lower down payment options.

September 2, 2023You may have heard the terms co-borrower and cosigner in connection with your FHA loan process, but aren't sure about the distinction. Both a co-borrower and a cosigner can help a primary borrower qualify for a mortgage, but they have different roles and responsibilities.

August 27, 2023The Federal Housing Administration has specific credit requirements and guidelines for borrowers looking to buy or refinance homes with an FHA loan. In addition to what FHA guidelines state, lenders may have more stringent requirements that may vary from one lender to another.