Understanding FHA Loan Debt Ratios

July 29, 2023

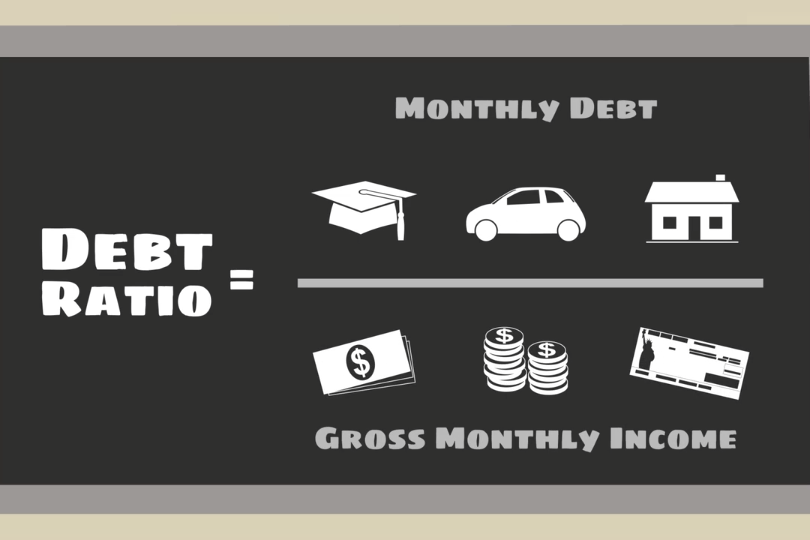

FHA loan debt ratios are financial benchmarks that assess a borrower's ability to manage their debt and make mortgage payments on time. These ratios play a pivotal role in the FHA loan approval process, as they provide a snapshot of a borrower's financial health. Two primary debt ratios are considered when evaluating an applicant's eligibility for an FHA loan:

Front-End Ratio (Housing Ratio)

This measures the percentage of a borrower's monthly gross income that will be allocated to housing-related expenses. These expenses include mortgage principal and interest, property taxes, homeowners insurance, and mortgage insurance premiums (if applicable). FHA guidelines typically require that the housing ratio does not exceed 31% of the borrower's gross income.

Back-End Ratio (Total Debt Ratio)

This is a broader measure of a borrower's debt load. It considers not only housing-related expenses but also other monthly obligations such as car loans, credit card payments, student loans, and any other outstanding debts. The FHA generally sets a maximum allowable back-end ratio of 43% of the borrower's gross income.

To improve your back-end ratio, focus on paying down existing debts, such as credit cards and personal loans. Reducing your overall debt load can make you a more attractive candidate for an FHA loan.

Both of these ratios serve as vital tools for lenders to assess your financial health and determine your eligibility for financing. By managing your debt wisely, increasing your income, and budgeting carefully, you can improve your debt ratios and increase your chances of securing an FHA loan. Remember that while debt ratios are an essential part of the approval process, they are just one piece of the puzzle, and other factors like credit score and down payment also play a role in determining your loan eligibility.

------------------------------

RELATED VIDEOS:

Let's Talk About Home Equity

Understanding Your Loan Term

Your Home Loan is Called a Mortgage

FHA Loan Articles

November 26, 2024

Thinking about buying a home? One of the first things you'll want to consider doing is filling out forms to be pre-approved for your FHA mortgage. This means a lender takes a look at your finances to figure out how much they're willing to loan you. It's a smart move, but you might be wondering: "Will applying for pre-approval hurt my credit score?"

November 25, 2024FHA mortgages include a refinance option that allows you to pull equity from your home in cash. The FHA cash-out refinance loan allows the borrower to take the difference between what remains to be paid on the home and the amount of equity built up.

The FHA loan program has some competition in this area, but how do your other government-backed refinance loan options measure up?

November 21, 2024The dream of homeownership is with some from a young age. But in an uncertain housing market, some grapple with the question: Is buying a home the right move for me?

While renting offers relocation flexibility and lower upfront costs, homeownership provides a wealth of financial and personal benefits.

November 20, 2024Refinancing your mortgage offers a way to cash in on your home equity, potentially reduce your interest rate, or modify your loan term. Borrowers ready to consider have options including FHA loans and conventional loans.

While both provide avenues for refinancing, each loan type may be best for specific needs and financial circumstances. What are the differences between FHA and conventional refinance options?

November 14, 2024The home you want to buy might seem perfect, or it may have a few flaws that are acceptable in the grand scheme of things. But what about issues you can’t spot just by walking through the property a few times? A home inspection provides an unbiased, expert assessment of the property's condition, uncovering potential issues that might not be noticeable to the untrained observer.