First-Time Homebuyer FAQs: Demystifying Mortgage Terms

February 26, 2025

I keep hearing about "principal" and "interest." What's the difference?

Think of it like this: the principal is the main dish – it's the actual amount of money you borrow from the lender to buy your home. The interest is like the extra side dishes and drinks you order. It's the cost of borrowing that principal amount. Interest is calculated as a percentage of the principal, and that percentage is your interest rate.

What does "loan term" mean, and why does it matter?

The loan term is simply the length of time you have to repay the mortgage, usually measured in years (e.g., 15 years, 30 years). It matters because a shorter term means higher monthly payments but less total interest paid over the life of the loan. A longer home loan term can bring lower monthly payments, but you'll end up paying more in interest over time.

How is my monthly payment determined?

Your mortgage payment is based on the principal, interest rate, and loan term. Part of that payment reduces the principal and there is a portion covering the interest. In the early years of your mortgage, more of your payment goes towards interest. Gradually, more and more goes towards paying down the principal.

What is amortization?

Amortization is just a fancy word for the process of gradually paying off your mortgage over time. An amortization schedule shows exactly how each monthly payment is divided between principal and interest, and how your loan balance decreases over the years.

What are the main types of mortgages I should know about?

There are several key types of mortgages. With a fixed-rate mortgage, your interest rate stays the same. It does not change during the loan term. This creates predictable monthly payments. In contrast, an adjustable-rate mortgage (ARM) has an interest rate that can change periodically, typically annually, which means your monthly payments can go up or down.

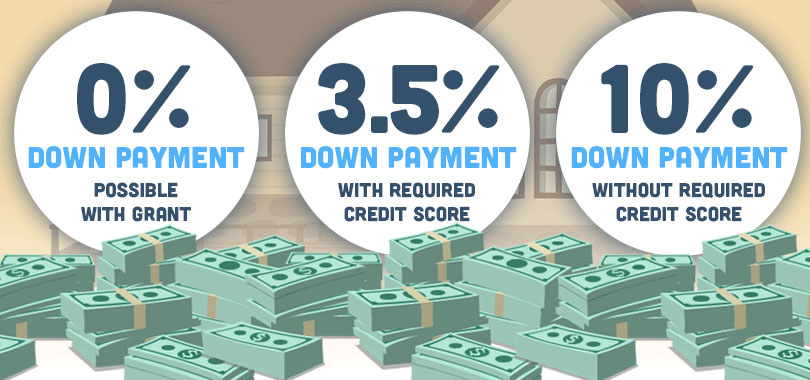

If you are a first-time homebuyer or have a lower credit score or smaller down payment, you might consider an FHA loan. These loans are insured by the Federal Housing Administration.

What are closing costs, and what do they include?

Closing costs are the various fees and expenses you pay to finalize your mortgage. They typically include things like a loan origination fee, an appraisal fee that covers the cost of assessing the property's value, title insurance, and recording fees paid to the government to record the sale.

What's the deal with mortgage insurance?

Mortgage insurance protects the lender. The insurance pays the lender if you default on the mortgage. For conventional loans, this is called Private Mortgage Insurance (PMI), while for FHA loans, it's called Mortgage Insurance Premium (MIP).

What is an escrow account?

An escrow account is like a holding pen for your property taxes and homeowners insurance payments. Your lender manages this account and uses it to pay those bills on your behalf, ensuring you stay current. Your mortgage payment may include money intended for escrow.

What are "prepaids" at closing?

Prepaids are upfront costs you cover at closing, such as prepaid interest, property taxes, and homeowners insurance premiums.

How does my credit score affect my mortgage?

Your FICO score is used to assess how risky it is to lend you money. A higher score generally means you'll qualify for a lower interest rate and better loan terms.

What does it mean to get pre-approved for a mortgage?

Getting pre-approved means a lender has reviewed your finances and given you an estimate of how much you can borrow. This is a smart move before house hunting because it shows sellers you're a serious buyer.

What are the Loan Estimate and Closing Disclosure?

These are important documents you'll receive during the mortgage process. The Loan Estimate provides an early estimate of your loan terms, interest rate, and closing costs, while the Closing Disclosure gives you the final details of your loan before you sign on the dotted line.

FHA Loan Articles

December 18, 2024Did holiday spending get the better of you? Are you looking for ways to recover your spending plan as you search for a new home?

The holidays are a whirlwind of festivities, family gatherings, and gift-giving. But amidst the cheer, it's easy to lose track of spending. If you're aiming to buy a home in the near future, those extra expenses can have a bigger impact than you might realize, especially if you're considering an FHA loan.

December 17, 2024The Federal Housing Administration provides mortgage insurance on loans made by FHA-approved lenders, making homeownership more attainable for those who might not qualify for conventional loans.

While financial factors like credit score and debt-to-income ratio are key to loan approval, other non-financial aspects can also cause a denial.

December 11, 2024FHA loans, insured by the Federal Housing Administration, are a popular choice for many homebuyers, especially those who need a lower downpayment or more forgiving credit qualifying requirements. FHA loans are primarily intended for primary residences—homes that borrowers will occupy as their main dwelling.

December 10, 2024The FHA announced increased loan limits for 2025, providing those seeking FHA-insured mortgages after January 1st with increased purchasing power. In this article, we explore the key aspects of these limits and their implications for your homeownership goals.

When you are approved for an FHA-insured loan, the FHA guarantees a portion of the loan to the lender, lowering lender risk...

December 9, 2024The Federal Housing Administration (FHA) helps people buy homes, especially those buying for the first time or who might not have perfect credit. In 2025, there is good news for FHA borrowers. FHA home loan limits are going up.

In most places, the FHA loan limit for a single-family home in 2025 is $524,225. This is more than it was in 2024. However, in expensive areas, where houses cost more, the limit can be as high as $1,209,750.