Fixing Your Credit Score

January 10, 2023

To start improving your credit score, it helps to know what goes into making it. The factors that affect your score are:

- Timely payments: 35%

- Overall debt: 30%

- Length of credit: 15%

- New credit applications: 10%

- Types of credit: 10%

Know Your Score

You need to know what your score is if you want to get started on improving it for a home loan. According to the Fair Credit Reporting Act, individuals have the right to their own credit report, which is available from a credit bureau. You can request your report from these bureaus, the top three of which are Equifax, TransUnion, and Experian. Once you have your report, you can review it and dispute any discrepancies. The bureaus are responsible for investigating any disputes within 30 days.

Don’t Let Your Balance Go Past-Due

The most important factor that makes up your credit score is your payment history. 35% of your credit report depends on whether or not you make payments on time. The later you are on those payments, the worse it is for your credit report. Always try to pay off your credit balances in full. Not only does this keep you from incurring large interest payments, but having a “paid in full” remark on your credit report looks good to lenders considering you for a loan.

Building a Credit History from Scratch

Many first-time homebuyers run into the problem of not having a sufficient credit history. This can affect the 15% of your score that depends on age of credit. Establishing credit history can start with signing up for a credit card and using it to pay for everyday items. It also helps to set up utility payments through your credit card online. Just remember to pay off the balance on time!

Be Proactive About Opening New Lines of Credit

When applying for a loan or credit card, your bank or lender performs a “hard inquiry.” This is a review of your credit that in turn affects your score. If you submit multiple credit applications in a short timeframe, it shows up as a red flag for lenders. They might assume that you aren’t handling your finances well enough if you need multiple lines of credit open at once. It’s important that you don’t submit credit applications close to the time that you apply for a home loan.

Remember that your credit score represents your creditworthiness. Based on this number, a lender determines whether you are a high-risk borrower and if it’s a smart idea to loan you a huge amount of money. It also determines the interest rate you’ll receive from the lender, so it is worth your time to work on increasing your score.

------------------------------

RELATED VIDEOS:

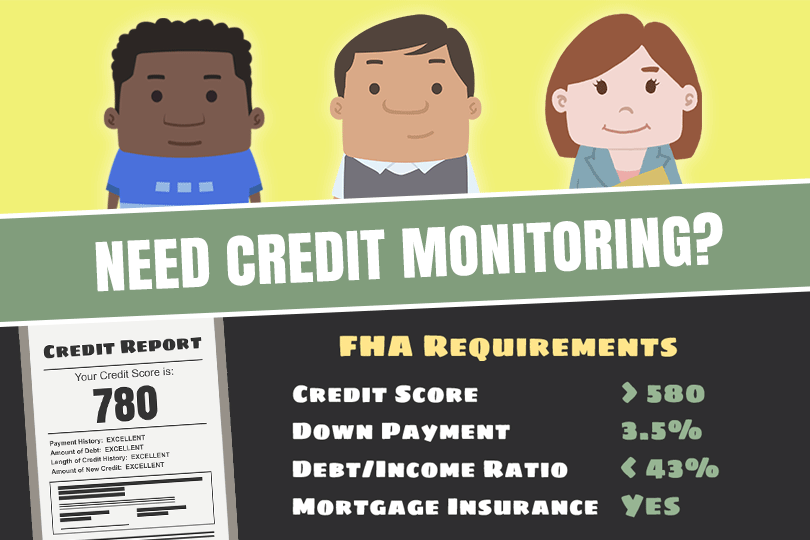

Learn How to Meet FHA Requirements

A Few Tips About Your Fixed Rate Mortgage

Your Proof of Ownership Is the Property Title

FHA Loan Articles

November 4, 2023In May 2023, USA Today published some facts and figures about the state of the housing market in America. If you are weighing your options for an FHA mortgage and trying to decide if it’s cheaper to buy or rent, your zip code may have a lot to do with the answers you get.

October 14, 2023FHA loan limits serve as a crucial mechanism to balance financial sustainability, regional variations in housing costs, and the agency's mission to promote homeownership, particularly for those with limited financial resources.

September 25, 2023Mortgage rates are hitting prospective homeowners hard this year and are approaching 8%, a rate that didn't seem very likely last winter. With so many people priced out of the market by the combination of high rates and a dwindling supply of homes.

September 19, 2023The FHA Handbook serves as a crucial resource for mortgage lenders, appraisers, underwriters, and other professionals involved in the origination and servicing of FHA-insured home loans. It outlines the policies and requirements for FHA-insured mortgages.

September 13, 2023FHA rehab loans are a specialized type of mortgage loan offered by the Federal Housing Administration that allows borrowers to finance both the purchase or refinance of a home and the cost of needed repairs.