Adjustable Rate Mortgage

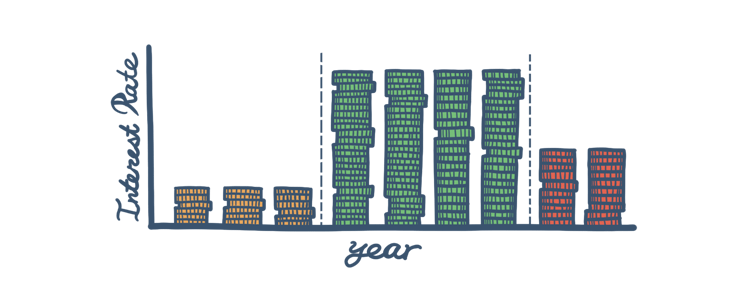

An adjustable-rate mortgage (ARM) has an interest rate that changes periodically through the life of the loan. ARMs come with an introductory period with a low, fixed rate. After this initial period, the interest rate applied to the outstanding balance varies based on the market index.

How the FHA ARM Works

The interest rate you get after the initial period is over is based on an index and your lender’s margin (which should be disclosed when you apply for the loan). The new interest rate is calculated by adding the margin to the index. As the index figure changes, so will your interest rate. The FHA accepts market index figures of the Constant Maturity Treasury (CMT) index or the 1-year London Interbank Offered Rate (LIBOR).

The idea of a large swing in the interest rates might make an ARM less appealing. That’s why the FHA places two types of caps, to provide a safeguard from astronomically high (or low) rates. There is an annual cap, which limits the points your interest rate can change year to year, and a “life-of-the-loan” cap that restricts the amount it can vary for the entire term of the loan.

FHA's ARM

The FHA has a few adjustable-rate mortgage options that can suit the needs of many borrowers. It offers a standard 1-year ARM and four "hybrid" ARM products, which have an initial interest rate that is fixed for the first 3, 5, 7, or 10 years. After that initial period, the interest rate adjusts annually.

The Pros

Choosing to finance a home with an ARM can work extremely well for some borrowers for a few reasons.

- Borrowers who intend to move and sell their home within a few years can take advantage of the low interest rates that come with the initial period of an adjustable-rate mortgage.

- Many homebuyers use the introductory period to save and budget for the future.

- Some borrowers may be expecting a significant increase in their income.

The Cons

It’s important to remember the downsides that come with the uncertainty of ARMs in order to make the best decision.

- There is always the chance that the index can go up drastically and your interest rate can skyrocket.

- When there is an uncertainty of how much you’ll be spending on monthly mortgage payments, budgeting isn’t as easy to do.

FHA Loan Articles

October 17, 2022If you’ve begun your search for a new home and are looking into mortgage options, you’ve likely heard of mobile, manufactured, and modular homes. While people working in real estate throw these terms around easily, it might be something that leaves everyday homebuyers confused.

September 17, 2022The FHA sets these limits annually according to the location and type of home, and it represents the maximum loan amount the agency will insure. Approved FHA-lenders can set their own requirements in addition to the FHA’s criteria for borrowers, such as higher credit scores.

June 16, 2022It’s a great option to consider if you want to build your dream home on your own land instead of buying someone else’s already-lived-in house. FHA One-Time Close mortgages are also referred to as single-close construction loans--you’ll see these terms used interchangeably.

May 7, 2022The appraisal process is a very important part of buying a home. When you are budgeting and planning for your loan, you may want to set aside some extra funds in case there are corrections required as the result of an appraisal.

April 12, 2022There is a major question some new borrowers have about home loans in general, that also applies to construction loans in particular. If you want to apply for an FHA One-Time Close construction loan, there are certain rules about loan funding that you should know about.

March 30, 2022Once you’ve decided that you’ll be purchasing a home, one of the first questions you need to ask yourself is what kind of mortgage you’ll be using to finance it. When it comes to shopping for a home loan, there are a number of options to consider.