Graduated Payment Mortgage

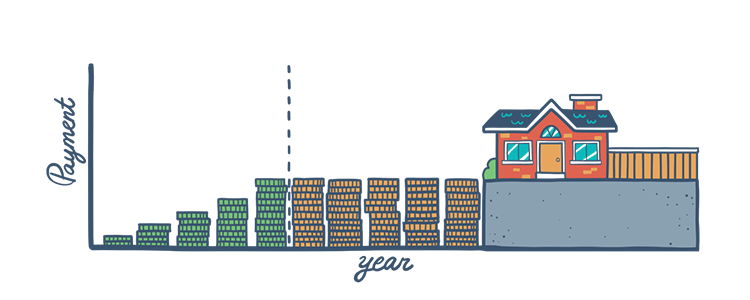

The FHA has a particular loan available for low- to moderate-income homebuyers who expect their incomes to increase in upcoming years. The Graduated Payment Mortgage (GPM), also known as HUD's Section 245(a), is a kind of fixed-rate mortgage that starts with lower monthly payments that gradually increase based on a predefined schedule. Typically, the GPM payments increase between 7-12% annually from the initial amount until the full monthly payment amount is reached.

How Does a GPM Work?

It's important to understand how the monthly mortgage payments for a graduated payment mortgage work differently than that of a regular fixed-rate loan. A graduated payment mortgage starts with smaller minimum payments, with the payment amount increasing gradually over time. The low introductory interest rates make it so more borrowers—who might not otherwise qualify—can afford the low initial payments and be eligible for the loan. Different payment plans are available with varying lengths and rate of payment increases, and some include a higher down payment as well.

The FHA offers five different GPM plans to suit borrowers' needs.

- Plan I:

Monthly mortgage payments increase 2.5% each year for 5 years - Plan II:

Monthly mortgage payments increase 5% each year for 5 years - Plan III:

Monthly mortgage payments increase 7.5% each year for 5 years - Plan IV:

Monthly mortgage payments increase 2% each year for 10 years - Plan V:

Monthly mortgage payments increase 3% each year for 10 years

Once the loan reaches the set time period of rate increase, monthly payments remain constant for the remainder of the mortgage term. Keep in mind that borrowers must make higher monthly payments toward the end of the loan as they'll begin to pay down the deferred debt.

Who's it For?

FHA's graduated payment mortgage program is available to finance single-family homes which must serve as the borrower's primary residence. The loan is ideally suited for low- to moderate-income who see their income levels increasing over the coming years. Buyers can tailor the monthly mortgage payments by picking the best plan, giving themselves the means to purchase a home sooner than they would be able to through conventional financing programs. In addition to the payment plans, GPMs come with FHA's flexible eligibility requirements, including low down payments and credit scores.

GPM borrowers should understand that over the life of the mortgage, they will pay more in interest than they would have had they chosen a mortgage with payments that remained the same over the life of the loan. While this type of loan is a great way to purchase a home earlier instead of renting, potential borrowers should also be critical and honest when assessing their future income increments and job security.

FHA Loan Articles

April 3, 2021Borrowers can choose to refinance for several reasons, but it comes down to prioritizing different benefits. One homeowner may want the lowest possible monthly payment, while another might want the shortest possible term for their loan.

March 24, 2021One of the major arguments people have for renting instead of buying is the large upfront cost of a down payment. Depending on the type of loan program you apply and are approved for, this could mean anything between 3.5% and 20% percent of your purchase price.

March 21, 2021The two basic types of home loans are fixed rate and adjustable-rate mortgages. The mortgage market offers many other options to homebuyers, but these two are the most common, and the first pair from which to pick.

March 15, 2021A key step in the mortgage process is the home appraisal. In the case of home purchase or refinance, this is a task that is almost always required by the lender, and it is important that potential homebuyers understand what, how, and why of a home appraisal.

March 10, 2021The renewable energy industry is growing more and more every year, and many homeowners have implemented energy-efficient strategies in their homes. This can include programmable thermostats, solar panels, new insulation in the attic, etc.

March 6, 2021When buying a home, you have a list of things you need to do. Get pre-approved, arrange for a home inspection, and a few other tasks. One important thing on that list is shopping for homeowner’s insurance.