How Livable Is Your Dream Home?

October 30, 2024

Did you know that FHA loans have minimum property standards to ensure the home is safe and livable? Those standards require the home to have an “economic life” for the entire term of the loan so you can freely sell the property later on if you choose to do so.

FHA minimum standards for homes secured with FHA mortgages include a review of the property's important features, including the electrical system, plumbing, roof, and foundation.

Mechanical Systems In The Home

FHA loan rules in HUD 4000.1 require that a home's heating, cooling, plumbing, and electrical systems be in working order and safe to use. As we’ll explore below, those systems must also be sufficient to serve the property they are installed in.

The FHA appraisal process may flag issues such as visibly faulty wiring, a leaking water heater, or an inefficient furnace. In cases of deficiencies, your seller may be required to repair or replace things in the home that do not meet FHA minimum standards.

Roof Issues

The roof is one of the most critical components of the home. HUD 4000.1 has noted in the past that the roof should have a remaining physical life of at least two years. If the appraiser notes issues with the roof, these may be required to be corrected before closing time.

Lead Paint

One important aspect of FHA minimum standards for all homes purchased with single-family FHA loans? Lead paint. While not always a health hazard, chipping or peeling paint can indicate deferred maintenance and moisture problems.

Peeling paint is considered a health and safety issue, and corrections may be required as a condition of loan approval. This is typically true at both the state and federal regulatory levels.

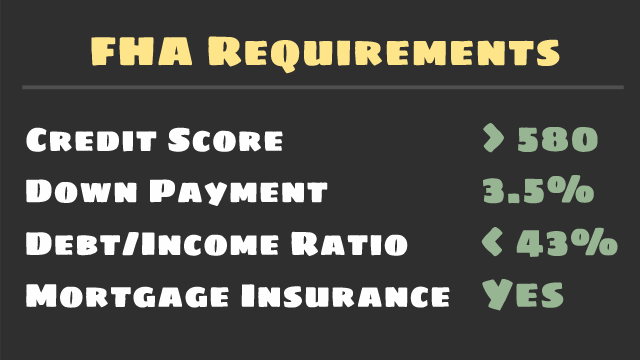

FHA Loan Requirements

FHA loan regulations include language such as "The water supply system must be adequate for the needs of the dwelling."

All home systems must meet this guideline. The home’s systems should be powerful enough to serve the entire property, not just a few rooms. That goes for water, septic, electrical, HVAC, and related systems.

FHA Loan Articles

May 24, 2021With historically low interest rates, the mortgage industry has seen a sharp uptick in refinances. Taking advantage of the current market might be in your best interest and could lower your monthly payment significantly. Don’t forget that refinancing a mortgage comes with closing costs.

May 8, 2021With a new waiver in place, Dreamers have access to affordable FHA home loans designed for first-time homebuyers. There is no discrepancy in the FHA’s eligibility requirements when it comes to DACA status holders applying for an FHA-backed mortgage. They must meet all the same criteria.

April 30, 2021Buying a house is overwhelming to begin with. Make it a seller’s market, and buyers become even more nervous. Supply of real estate has been low for most of 2021, in part because of the Coronavirus pandemic and the historically low interest rates since 2019.

April 23, 2021No matter what kind of market you’re in, it is always best to get pre-approved before going to shop for houses. The last thing you want is to go look at homes, find the one you love, then have to wait on an approval and lose the dream home to another buyer.

April 11, 2021With the trend of falling interest rates since 2019, the number of mortgage refinances around the country has spiked and continues to rise. Borrowers with FHA loans can also capitalize on the low rates, but it may be possible to simplify the process with the FHA Streamline Refinance.