FHA Adjustable Rate Mortgages in 2021

February 21, 2021

The Index Changes

Lenders use a specific market index off of which an ARM’s interest rates are based. Until recently, most financial institutions, including the FHA, were using the London Inter-bank Offered Rate (LIBOR), but it was decided that effective January 3, 2022, the mortgage industry will put aside LIBOR and adopt the Secured Overnight Funding Rate (SOFR). The U.S. Federal Reserve Board and New York Federal Reserve are set to oversee the transition from LIBOR to SOFR, and have recommended that most new ARMs use SOFR instead of LIBOR beginning in September, 2020.

Why Does This Matter?

To understand why this change matters, you must know how an ARM works. The interest rate you get with an ARM is based on an index and a margin (which is disclosed when you apply for the loan). Your adjustable rate is calculated by adding the loan margin to the index, so as the index figure changes, so will your interest rate.

With the implementation of a new index, the changing rates of ARMs may start to look different. While both LIBOR and SOFR are used to measure the cost of short-term borrowing, the indexes measure that cost differently. Greg McBride, chief financial analyst at Bankrate states that, “SOFR is based on actual market transactions whereas LIBOR was determined by what various banks would charge each other to borrow on an overnight basis.” When it became clear that certain banks were able to manipulate the LIBOR rate, SOFR was created to be a more accurate and reliable index that is less susceptible to such manipulation.

While the majority of borrowers and loan applicants will not be affected by the new mandate, those with adjustable- rate mortgages, a home equity loan, or a reverse mortgage might see changes to their loan depending on how it is indexed.

McBride states that ARMS based on LIBOR will no longer be purchased by Fannie Mae and Freddie Mac. "SOFR is rapidly replacing it. Treasury-indexed ARMs are unaffected.”

Next Steps

It is important for borrowers to be in the know, and stay on top changes in their interest rate. While it is expected that the changes will relatively minor, mortgage holders with an ARM should contact their loan servicers to see which index their mortgage is based on, to avoid being caught off guard with the next adjustment. If the loan is tied to LIBOR, lenders can help identify when it will switch to SOFR and what that change could mean for the particular ARM.

------------------------------

RELATED VIDEOS:

Disclosures Give Transparency to Borrowers

Understanding the Purpose of Your Mortgage Down Payment

Putting Money Into Your Escrow Account

FHA Loan Articles

October 31, 2024When buying a home for the first time, it helps to know how long the process can take. How do you know if your appraisal report is delayed if you don’t know how long the FHA allows for the process to be completed? How long does it take to get from the final offer to closing day? A “typical” FHA loan process may take up to 45 days from start to finish. Several factors can influence this timeline.

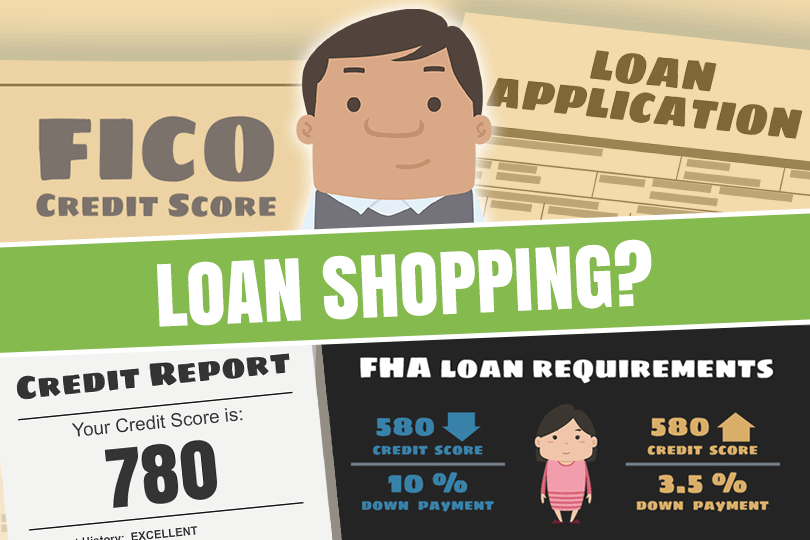

October 30, 2024Just because an FHA loan is designed to be more lenient with FICO scores and require a lower down payment doesn’t mean the house you buy with that loan is less than ideal. Did you know that FHA loans have minimum property standards to ensure the home is safe and livable? Those standards require the home to have an “economic life” for the entire term of the loan so you can freely sell the property later on if you choose to do so.

October 29, 2024Buying a home with an FHA mortgage is a major life decision, and preparation is essential before you start house hunting or consider making an offer on a property.

How to get started? In the early stages, establishing your budget and how much work you need to do on your credit is key. But once you have gotten past the initial phase of that planning you’ll want to consider the house itself and what you want from it.

October 25, 2024Mixed-use properties combine residential and commercial spaces. Some borrowers applying for FHA home loans want to know if purchasing such a property using an FHA single-family home loan is possible. The FHA does allow the use of its loans for mixed-use properties, but certain conditions must be met.

October 24, 2024Buying your first home is a major milestone. If you use an FHA mortgage to buy your home, you’ll have two types of insurance to consider. One type is the FHA-required mortgage insurance premium, which is paid for 11 years or the loan's lifetime, depending on your down payment, loan term, and other variables.