Credit Matters: What to Know Before Applying for a Home Loan

October 17, 2024

Buying a home is one of the most significant investments Americans make. Understanding how to strengthen your credit profile and leverage the power of credit counseling is essential for successfully navigating the FHA loan process.

What should you know about your credit to make the most of your home-buying journey? We examine some key points below.

Why Credit Matters for FHA Loans

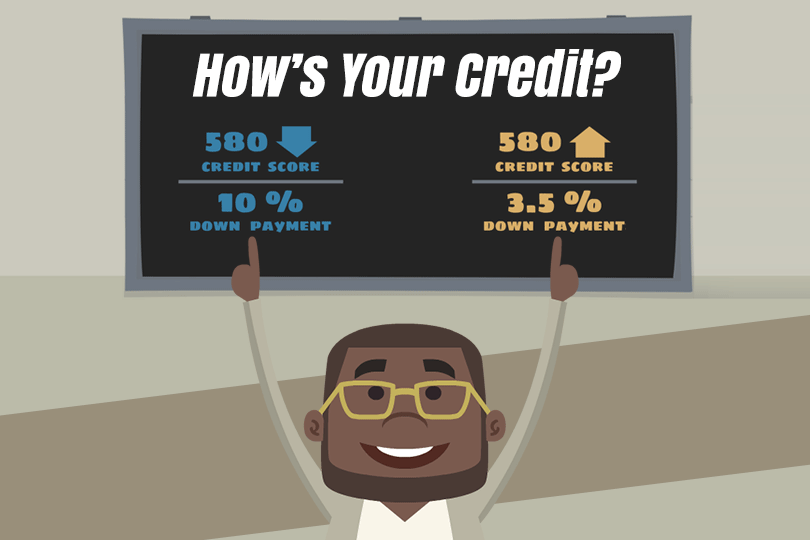

While FHA loans are known for their flexibility, your credit score is a major factor in the application process. FICO scores indicate your financial responsibility and ability to manage debt.

Your Credit Score: A Breakdown Of Lender Priorities

- Payment History (35%): Some believe payment history is one of the most influential credit factors. Lenders want a consistent history of on-time payments for all financial obligations.

- Amounts Owed (30%): Your credit utilization ratio (the percentage of available credit you use) is another critical factor. High credit utilization can signal financial strain and negatively impact your score. An ideal credit utilization ratio? Below 30%, preferably below 10%.

- Length of Credit History (15%): A longer credit history, in theory, shows greater financial responsibility. Lenders will look at the age of your oldest account and reference the average age of all the accounts in your name, as well as how recently you've used your credit.

- Credit Mix (10%): In some cases, having a diverse mix of credit options is a good sign. Having credit cards, installment loans, and mortgages may positively influence your score.

- New Credit (10%): Quickly opening multiple new credit accounts is not a good idea. Doing so may lower your FICO scores. The reason? A credit application triggers a "hard inquiry" on your credit report, which can be seen as a sign of increased risk.

7 Actionable Steps to Elevate Your Credit for an FHA Loan

1. Obtain and Scrutinize Your Credit Report

Request a free credit report from Equifax, Experian, and TransUnion. You can do this through AnnualCreditReport.com. The credit bureaus must provide you with one free report a year. Thoroughly review each report for errors, inaccuracies, or outdated information. Dispute any discrepancies with the respective credit bureau, providing supporting documentation as needed.

2. Prioritize On-Time Payments

Do not miss payments for any bills, including credit cards, utilities, loans, and rent. Set up automatic payments. Or use reminders to avoid late payments, which can significantly damage your credit. If you've had late payments in the past, focus on establishing a consistent pattern of on-time payments moving forward.

3. Strategically Manage Credit Card Balances

Work to get your credit utilization ratio below 30% on each card and on all other accounts. Prioritize paying down high-interest credit cards first. Consolidating multiple credit card balances into a single lower-interest loan may be a good option. Doing so can simplify payments and potentially reduce interest costs.

4. Exercise Caution with New Credit Applications

Avoid applying for new credit. Each hard inquiry can slightly lower your score, especially if you have several within a short time frame. If you need new credit, consider applying for a secured credit card. These cards require a security deposit that serves as your credit limit.

5. Preserve Your Credit History

Avoid closing old credit accounts, even if you no longer use them. Closing old accounts may affect your credit history and reduce your available credit. If you have an old account with a negative history, consider contacting the creditor to see if they offer goodwill adjustments to remove the negative mark.

6. Leverage Authorized User Status

If you have limited credit history or are rebuilding your credit, becoming an authorized user on a responsible person's credit card account can be beneficial. Ensure the account has a low credit utilization ratio and a history of on-time payments. Some credit scoring models don't give as much weight to authorized user accounts, an important variable to remember.

7. Explore Secured Credit Cards

Secured credit cards can help you establish credit or rebuild your score. Use your secured card responsibly, make small purchases, and pay your balance in full and on time each month. Some secured cards allow you to upgrade to an unsecured card after responsible use.

FHA Loan Articles

October 22, 2024While the Federal Housing Administration sets rules for FHA loans, lenders retain some flexibility in determining interest rates, fees, and specific loan terms. Depending on circumstances, the FHA loan offered by your local bank might not be as competitive as one offered by a credit union or an online lender specializing in FHA products, or vice versa.

October 17, 2024Buying a home is one of the most significant investments Americans make. Understanding how to strengthen your credit profile and leverage the power of credit counseling is essential for successfully navigating the FHA loan process. What should you know about your credit to make the most of your home-buying journey?

March 13, 2024There are plenty of reasons to delay plans to refinance a home. One reason has made big headlines. When borrowers face higher interest rates than originally approved for, that is a good reason to wait to refinance.

February 12, 2024When you are approved for an FHA One-Time Close Construction loan, you get a single loan that pays for both the costs to build the house, and serves as the mortgage. One application, one approval process, and one closing date.

November 22, 2023In the last days of November 2023, mortgage loan rates flirted with the 8% range but have since backed away, showing small but continued improvement. What does this mean for house hunters considering their options to become homeowners soon?