What to Know About the FHA Handbook

September 19, 2023

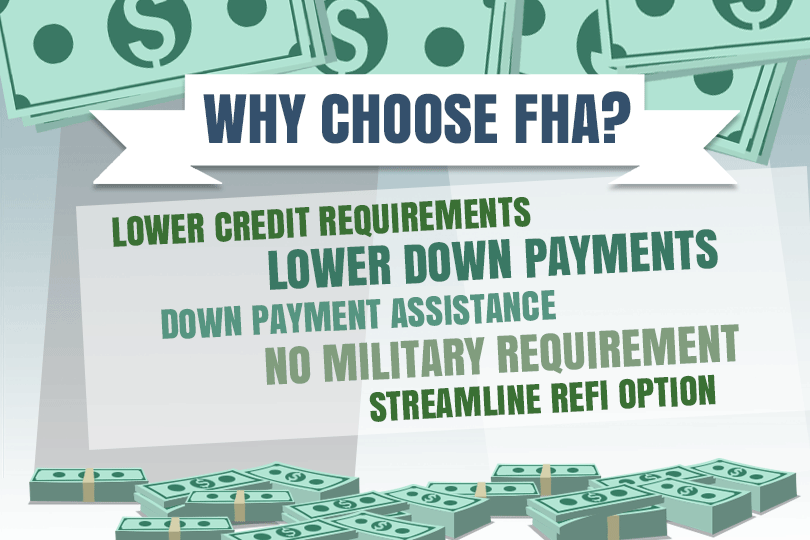

The FHA Handbook outlines the policies and requirements for FHA-insured mortgages, which are popular among first-time homebuyers and borrowers with lower credit scores or smaller down payments. It provides detailed instructions and guidelines on various aspects of the FHA loan program, including eligibility criteria, underwriting standards, property appraisal requirements, and mortgage insurance.

Key components covered in the FHA Handbook include:

Eligibility Requirements

The handbook explains who is eligible for an FHA loan, including minimum credit score requirements, debt-to-income ratios, and down payment guidelines.

Property Standards

It describes the property requirements that must be met for a home to qualify for FHA financing. This includes guidelines for the condition and safety of the property.

Appraisal Guidelines

The FHA Handbook outlines the specific requirements for property appraisals, ensuring that the property's value is accurately determined.

Credit Underwriting

It provides guidance on how lenders should assess the creditworthiness of FHA loan applicants, including requirements for handling credit issues and disputes.

Mortgage Insurance

Details on FHA mortgage insurance premiums, including both upfront and annual premiums, are included.

Closing and Settlement Costs

Information on allowable and non-allowable fees and costs for the borrower, as well as the seller's contributions.

Loan Origination and Processing

Guidelines for the processing of FHA loan applications, including required documentation and borrower verification.

Servicing and Loss Mitigation

Information on loan servicing requirements and how to handle delinquencies and foreclosures.

The FHA Handbook is periodically updated to reflect changes in FHA policies and industry best practices. Lenders and other professionals involved in FHA lending are required to adhere to the guidelines outlined in the handbook to ensure that loans meet FHA standards and qualify for FHA insurance.

------------------------------

RELATED VIDEOS:

There's a Difference Between APR and Interest Rates

Choose Your Mortgage Lender Carefully

Getting Started With Your FHA Loan Application

FHA Loan Articles

March 6, 2021When buying a home, you have a list of things you need to do. Get pre-approved, arrange for a home inspection, and a few other tasks. One important thing on that list is shopping for homeowner’s insurance.

February 26, 2021Many Americans go with FHA loans because there are a number of mortgage programs that can fit different needs. These programs include FHA Fixed Rate Loans, FHA Adjustable Rate Mortgages, FHA One-Time Close Loans, FHA Condo Loans, and several others.

February 21, 2021The new year came with some changes being made in the mortgage industry, particularly when it comes to Adjustable- Rate Mortgages, or ARMs. The interest rate you get with an ARM is based on an index and a margin which is disclosed when you apply for the loan.

February 6, 2021As an existing homeowner, you may want to take advantage of falling interest rates by refinancing your current mortgage. For many homeowners, the thought of going through the refinancing process can be tiresome. But an FHA Streamline Refinance could help you avoid the extra work.

January 30, 2021As your closing day gets closer and closer, you might start to feel a little nervous. Do you have everything you need? Will something delay the closing? These worries are natural, but the more prepared you are, the less overwhelming it will all seem.