What to Know About the FHA Handbook

September 19, 2023

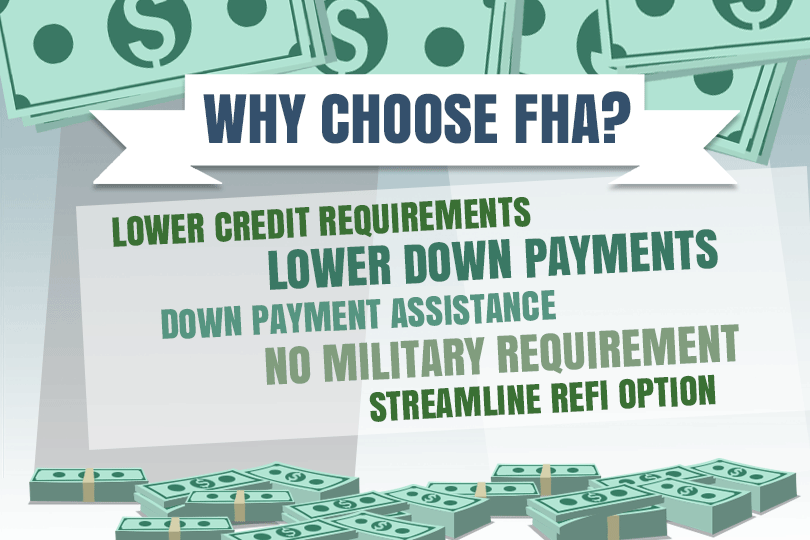

The FHA Handbook outlines the policies and requirements for FHA-insured mortgages, which are popular among first-time homebuyers and borrowers with lower credit scores or smaller down payments. It provides detailed instructions and guidelines on various aspects of the FHA loan program, including eligibility criteria, underwriting standards, property appraisal requirements, and mortgage insurance.

Key components covered in the FHA Handbook include:

Eligibility Requirements

The handbook explains who is eligible for an FHA loan, including minimum credit score requirements, debt-to-income ratios, and down payment guidelines.

Property Standards

It describes the property requirements that must be met for a home to qualify for FHA financing. This includes guidelines for the condition and safety of the property.

Appraisal Guidelines

The FHA Handbook outlines the specific requirements for property appraisals, ensuring that the property's value is accurately determined.

Credit Underwriting

It provides guidance on how lenders should assess the creditworthiness of FHA loan applicants, including requirements for handling credit issues and disputes.

Mortgage Insurance

Details on FHA mortgage insurance premiums, including both upfront and annual premiums, are included.

Closing and Settlement Costs

Information on allowable and non-allowable fees and costs for the borrower, as well as the seller's contributions.

Loan Origination and Processing

Guidelines for the processing of FHA loan applications, including required documentation and borrower verification.

Servicing and Loss Mitigation

Information on loan servicing requirements and how to handle delinquencies and foreclosures.

The FHA Handbook is periodically updated to reflect changes in FHA policies and industry best practices. Lenders and other professionals involved in FHA lending are required to adhere to the guidelines outlined in the handbook to ensure that loans meet FHA standards and qualify for FHA insurance.

------------------------------

RELATED VIDEOS:

There's a Difference Between APR and Interest Rates

Choose Your Mortgage Lender Carefully

Getting Started With Your FHA Loan Application

FHA Loan Articles

March 16, 2023Planning your FHA loan means asking some important questions early in the process. The most obvious question is associated with the type of home you want. How large a house do you need? FHA mortgages allow the purchase of homes with between one and four living units.

February 7, 2023There are tons of reasons why people decide that they’re done with renting and start looking into buying a home. Whatever your reason, deciding to buy a home is a big step, and one of the most daunting aspects is saving up enough money for the down payment.

January 27, 2023Before you get ready to commit to a home loan application, it’s good to review your circumstances and ask a few basic questions about your loan, your plans, and the home itself. Believe it or not, knowing what type of home loan you need is an important step.

January 10, 2023When getting ready to shop for a home loan, it's worth taking a look at your credit report. Your credit score is a big factor when lenders take a look at your loan application, and it plays a huge role in the interest rate you get.

December 23, 2022When it comes to buying a house, saving up for a down payment can be one of the most overwhelming aspects. While down payments are one of the biggest obstacles for many in the mortgage process, it helps to understand the ins and outs of why they play such a big role.