Can I Get a No Money Down FHA Loan?

August 14, 2023

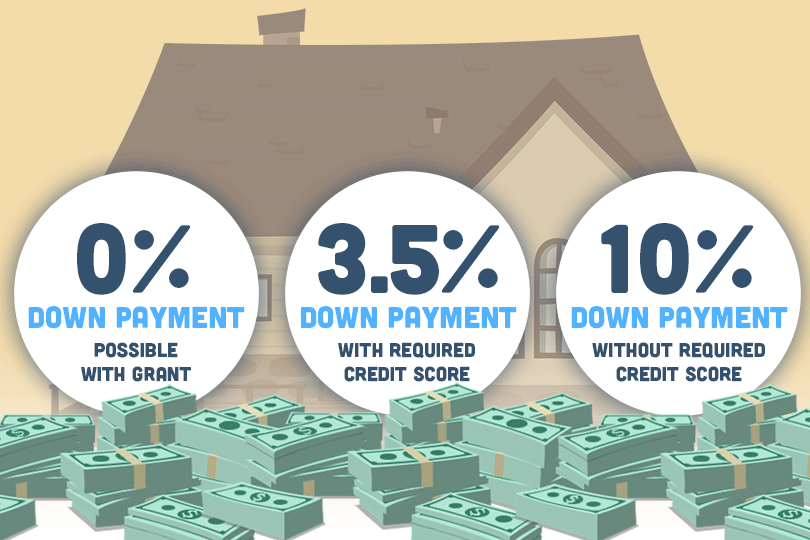

FHA loans typically require a minimum down payment of 3.5% of the purchase price of the home with the right credit score. This means that if you're buying a house for $240,000, you would need to make a down payment of at least $8,400. The down payment can come from your own funds, a gift from a family member, or a down payment assistance program. If your credit score is below the standard requirement set by you lender you may have to increase your down payment to 10% of the loan.

It's important to note that while the down payment requirement for FHA loans is relatively low, you will still need to cover closing costs, which can include fees for appraisals, inspections, title insurance, and more. These costs are separate from the down payment.

Additionally, FHA loans have mortgage insurance premiums (MIP) that borrowers are required to pay, both upfront and as part of their monthly mortgage payments. This insurance helps protect the lender in case the borrower defaults on the loan.

Please keep in mind that loan program guidelines can change over time, so it's a good idea to consult with a mortgage lender or FHA-approved lender for the most up-to-date information on FHA loan options and requirements, especially if you are considering purchasing a home today.

------------------------------

RELATED VIDEOS:

Annual Income Requirements for FHA Loans

Good Credit History Helps Get FHA Loans

Stay Informed About Your Mortgage Closing Costs

FHA Loan Articles

March 29, 2021The FHA helps first-time and low-income homebuyers by having lower down payment requirements for its borrowers. Despite this lower credit eligibility criteria set by FHA, it is important to remember that FHA-approved lenders can set their own requirements

March 24, 2021One of the major arguments people have for renting instead of buying is the large upfront cost of a down payment. Depending on the type of loan program you apply and are approved for, this could mean anything between 3.5% and 20% percent of your purchase price.

March 21, 2021The two basic types of home loans are fixed rate and adjustable-rate mortgages. The mortgage market offers many other options to homebuyers, but these two are the most common, and the first pair from which to pick.

March 15, 2021A key step in the mortgage process is the home appraisal. In the case of home purchase or refinance, this is a task that is almost always required by the lender, and it is important that potential homebuyers understand what, how, and why of a home appraisal.

March 10, 2021The renewable energy industry is growing more and more every year, and many homeowners have implemented energy-efficient strategies in their homes. This can include programmable thermostats, solar panels, new insulation in the attic, etc.