Understanding FHA Loan Debt Ratios

July 29, 2023

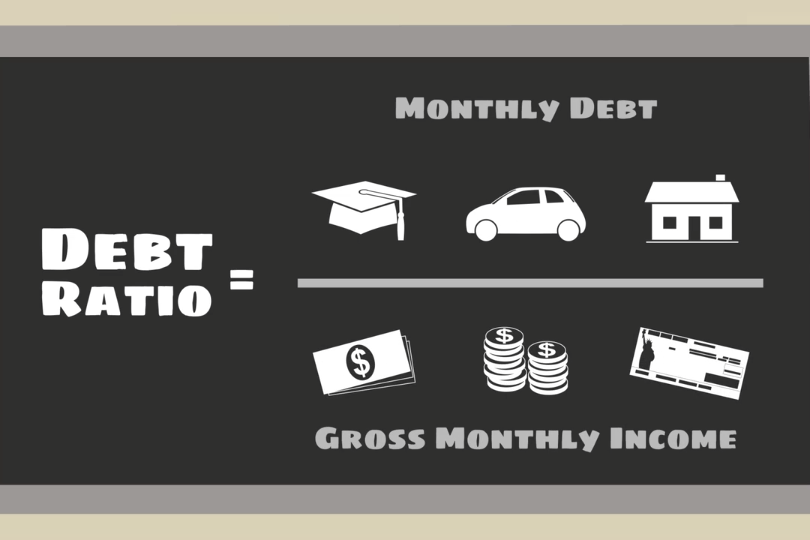

FHA loan debt ratios are financial benchmarks that assess a borrower's ability to manage their debt and make mortgage payments on time. These ratios play a pivotal role in the FHA loan approval process, as they provide a snapshot of a borrower's financial health. Two primary debt ratios are considered when evaluating an applicant's eligibility for an FHA loan:

Front-End Ratio (Housing Ratio)

This measures the percentage of a borrower's monthly gross income that will be allocated to housing-related expenses. These expenses include mortgage principal and interest, property taxes, homeowners insurance, and mortgage insurance premiums (if applicable). FHA guidelines typically require that the housing ratio does not exceed 31% of the borrower's gross income.

Back-End Ratio (Total Debt Ratio)

This is a broader measure of a borrower's debt load. It considers not only housing-related expenses but also other monthly obligations such as car loans, credit card payments, student loans, and any other outstanding debts. The FHA generally sets a maximum allowable back-end ratio of 43% of the borrower's gross income.

To improve your back-end ratio, focus on paying down existing debts, such as credit cards and personal loans. Reducing your overall debt load can make you a more attractive candidate for an FHA loan.

Both of these ratios serve as vital tools for lenders to assess your financial health and determine your eligibility for financing. By managing your debt wisely, increasing your income, and budgeting carefully, you can improve your debt ratios and increase your chances of securing an FHA loan. Remember that while debt ratios are an essential part of the approval process, they are just one piece of the puzzle, and other factors like credit score and down payment also play a role in determining your loan eligibility.

------------------------------

RELATED VIDEOS:

Let's Talk About Home Equity

Understanding Your Loan Term

Your Home Loan is Called a Mortgage

FHA Loan Articles

March 10, 2025Even if you aren’t considering your home loan options right this second, it’s smart to know your options if you decide to pursue a new home later. To that end, using a mortgage calculator is a smart choice for setting some basic budgeting parameters as you plan your path toward home ownership. A mortgage calculator helps you plan for future financial scenarios, such as buying new or refinancing a current home.

February 27, 2025 Buying your first home can feel overwhelming, especially when you start hearing terms like "subprime mortgages" and "FHA loans." Understanding these options is crucial for making the right decision. Subprime mortgages are designed for borrowers with less-than-perfect credit histories. This might include past issues like late payments, loan defaults, or even bankruptcy...

February 26, 2025Buying your first home can be exciting, but the mortgage process often throws a curveball of unfamiliar terms. Here are answers to common questions first-time homebuyers have about mortgage jargon and terms.

February 18, 2025Mortgages typically require mortgage insurance and homeowners insurance. They are both key parts of your home loan but they serve very different functions. Do you know the differences between the two? Find out how ready you are to begin the process of buying your new house.

February 17, 2025The federal government backs FHA home loans, which allows participating FHA lenders to offer lower down payment options and more lenient credit requirements. How much do you really know about your FHA home loan options and how they compare to other mortgage choices?