Understanding FHA Loan Debt Ratios

July 29, 2023

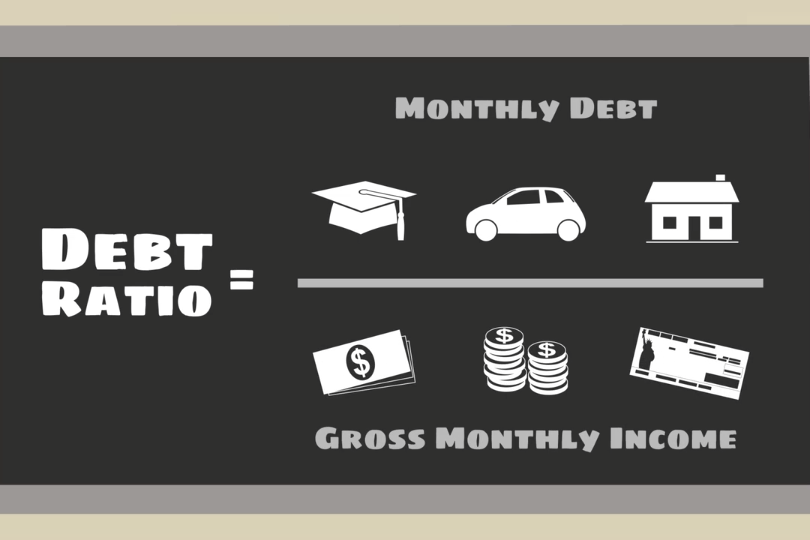

FHA loan debt ratios are financial benchmarks that assess a borrower's ability to manage their debt and make mortgage payments on time. These ratios play a pivotal role in the FHA loan approval process, as they provide a snapshot of a borrower's financial health. Two primary debt ratios are considered when evaluating an applicant's eligibility for an FHA loan:

Front-End Ratio (Housing Ratio)

This measures the percentage of a borrower's monthly gross income that will be allocated to housing-related expenses. These expenses include mortgage principal and interest, property taxes, homeowners insurance, and mortgage insurance premiums (if applicable). FHA guidelines typically require that the housing ratio does not exceed 31% of the borrower's gross income.

Back-End Ratio (Total Debt Ratio)

This is a broader measure of a borrower's debt load. It considers not only housing-related expenses but also other monthly obligations such as car loans, credit card payments, student loans, and any other outstanding debts. The FHA generally sets a maximum allowable back-end ratio of 43% of the borrower's gross income.

To improve your back-end ratio, focus on paying down existing debts, such as credit cards and personal loans. Reducing your overall debt load can make you a more attractive candidate for an FHA loan.

Both of these ratios serve as vital tools for lenders to assess your financial health and determine your eligibility for financing. By managing your debt wisely, increasing your income, and budgeting carefully, you can improve your debt ratios and increase your chances of securing an FHA loan. Remember that while debt ratios are an essential part of the approval process, they are just one piece of the puzzle, and other factors like credit score and down payment also play a role in determining your loan eligibility.

------------------------------

RELATED VIDEOS:

Let's Talk About Home Equity

Understanding Your Loan Term

Your Home Loan is Called a Mortgage

FHA Loan Articles

November 12, 2024Escrow is an important feature of most typical FHA loans. An escrow account is a third-party account where borrowers deposit funds designated for property taxes and other uses. Requirements to use escrow accounts typically stems from a need to protect all parties involved in the transaction

November 2, 2024When it’s time to consider buying a home, the Federal Housing Administration (FHA) offers two popular options. One is the traditional FHA purchase loan many use to buy a house in the suburbs. But not everyone wants to buy an existing property. Some want more control over the design and configuration of the home.

The other FHA construction loan option, the one-time close mortgage, comes in here. This option is for those who want to approve floor plans, have a say in the types of materials used to build the home and choose its features.

October 31, 2024When buying a home for the first time, it helps to know how long the process can take. How do you know if your appraisal report is delayed if you don’t know how long the FHA allows for the process to be completed? How long does it take to get from the final offer to closing day? A “typical” FHA loan process may take up to 45 days from start to finish. Several factors can influence this timeline.

October 30, 2024Just because an FHA loan is designed to be more lenient with FICO scores and require a lower down payment doesn’t mean the house you buy with that loan is less than ideal. Did you know that FHA loans have minimum property standards to ensure the home is safe and livable? Those standards require the home to have an “economic life” for the entire term of the loan so you can freely sell the property later on if you choose to do so.

October 29, 2024Buying a home with an FHA mortgage is a major life decision, and preparation is essential before you start house hunting or consider making an offer on a property.

How to get started? In the early stages, establishing your budget and how much work you need to do on your credit is key. But once you have gotten past the initial phase of that planning you’ll want to consider the house itself and what you want from it.