How Much Do I Need to Put Down on a House

September 20, 2021

Minimum Down Payment Requirements

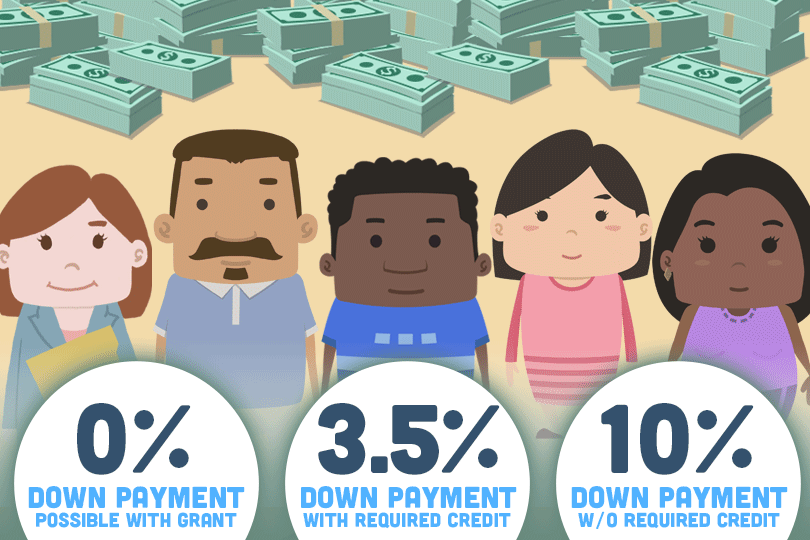

Different lenders have different requirements when it comes to the down payment on a home loan.

- FHA loans, backed by the Federal Housing Administration, require only 3.5% down with a 580 credit score.

- VA loans, insured by the U.S. Department of Veterans Affairs, for current and veteran military service members and eligible surviving spouses, have no down payment requirement.

- USDA loans, guaranteed by the U.S. Department of Agriculture's Rural Development Program, do not require a down payment.

- Most conventional loans (those not insured by the government), require a minimum down payment of 20%.

Lenders look favorably on borrowers who are able to make a sizeable down payment, as it gives them peace of mind. FHA-approved lenders feel more secure accepting a smaller down payment since they are insured by the government agency, and the lenders are protected in the case borrowers are unable to pay back the mortgage amount.

Mortgage Insurance

Applying for a conventional mortgage may mean paying for Private Mortgage Insurance (PMI). This is charged to borrowers when they are unable to make the minimum down payment (usually 20%) but still want to apply for it. While this option helps qualify for the loan, it also increases the cost of the loan itself. Borrowers can make a lower down payment upfront, but the monthly PMI premium is added to the mortgage payments. It is also important to remember that PMI does not protect the borrower. Instead, it protects the lender from losses if the borrower defaults on the loan. In most cases, borrowers will only have to pay for PMI until they have amassed enough equity in the home (usually up to the 20% requirement), and can have the premium dropped at that point. Talk to your loan officer to make sure this is an option.

How Down Payments Can Affect Your Interest

The amount of money directly impacts the amount of interest you pay over the life of the loan. Making a larger down payment means paying less in interest, since you are borrowing less money. Imagine that you are buying a $200,000-home with a down payment of $20,000. You will be paying interest on a $180,000 loan. (200,000 – 20,000). However, if you pay only $10,000 upfront, you will be paying interest on a $190,000-loan instead.

Trying to calculate how much money to put down on your home can be daunting, but having the information you need makes the decision easier. It is important that as a potential homebuyer that you do your research and learn about your options, including Down Payment Assistance Programs. Head to www.fha.com to for a comprehensive list of programs for each state.

------------------------------

RELATED VIDEOS:

Do What You Can to Avoid Foreclosure

Homes Financed With FHA Loans Must Be Owner Occupied

FHA Programs for First-Time Homebuyers

FHA Loan Articles

September 8, 2023Borrowers considering an FHA loan should be familiar with some basic loan terminology. These loans are popular among first-time homebuyers and those with lower credit scores because they often offer more flexible eligibility requirements and lower down payment options.

September 2, 2023You may have heard the terms co-borrower and cosigner in connection with your FHA loan process, but aren't sure about the distinction. Both a co-borrower and a cosigner can help a primary borrower qualify for a mortgage, but they have different roles and responsibilities.

August 27, 2023The Federal Housing Administration has specific credit requirements and guidelines for borrowers looking to buy or refinance homes with an FHA loan. In addition to what FHA guidelines state, lenders may have more stringent requirements that may vary from one lender to another.

August 23, 2023Mortgage APR (Annual Percentage Rate) and a loan's interest rate are two different things, although they are closely related. Understanding the difference is an important part of a borrower's analysis of the true cost of their mortgage.

August 19, 2023FHA refinance loans allow homeowners with existing FHA loans to refinance their mortgages. These loans are designed to help borrowers take advantage of lower interest rates, reduce their monthly mortgage payments, or access equity in their homes for various purposes.