First-Time Homebuyer FAQs: Demystifying Mortgage Terms

February 26, 2025

I keep hearing about "principal" and "interest." What's the difference?

Think of it like this: the principal is the main dish – it's the actual amount of money you borrow from the lender to buy your home. The interest is like the extra side dishes and drinks you order. It's the cost of borrowing that principal amount. Interest is calculated as a percentage of the principal, and that percentage is your interest rate.

What does "loan term" mean, and why does it matter?

The loan term is simply the length of time you have to repay the mortgage, usually measured in years (e.g., 15 years, 30 years). It matters because a shorter term means higher monthly payments but less total interest paid over the life of the loan. A longer home loan term can bring lower monthly payments, but you'll end up paying more in interest over time.

How is my monthly payment determined?

Your mortgage payment is based on the principal, interest rate, and loan term. Part of that payment reduces the principal and there is a portion covering the interest. In the early years of your mortgage, more of your payment goes towards interest. Gradually, more and more goes towards paying down the principal.

What is amortization?

Amortization is just a fancy word for the process of gradually paying off your mortgage over time. An amortization schedule shows exactly how each monthly payment is divided between principal and interest, and how your loan balance decreases over the years.

What are the main types of mortgages I should know about?

There are several key types of mortgages. With a fixed-rate mortgage, your interest rate stays the same. It does not change during the loan term. This creates predictable monthly payments. In contrast, an adjustable-rate mortgage (ARM) has an interest rate that can change periodically, typically annually, which means your monthly payments can go up or down.

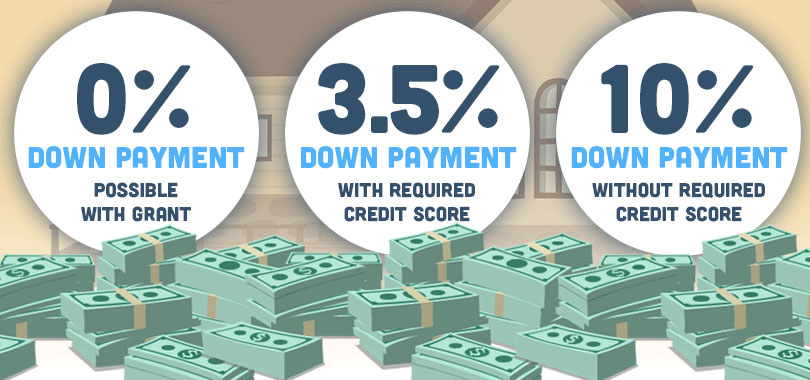

If you are a first-time homebuyer or have a lower credit score or smaller down payment, you might consider an FHA loan. These loans are insured by the Federal Housing Administration.

What are closing costs, and what do they include?

Closing costs are the various fees and expenses you pay to finalize your mortgage. They typically include things like a loan origination fee, an appraisal fee that covers the cost of assessing the property's value, title insurance, and recording fees paid to the government to record the sale.

What's the deal with mortgage insurance?

Mortgage insurance protects the lender. The insurance pays the lender if you default on the mortgage. For conventional loans, this is called Private Mortgage Insurance (PMI), while for FHA loans, it's called Mortgage Insurance Premium (MIP).

What is an escrow account?

An escrow account is like a holding pen for your property taxes and homeowners insurance payments. Your lender manages this account and uses it to pay those bills on your behalf, ensuring you stay current. Your mortgage payment may include money intended for escrow.

What are "prepaids" at closing?

Prepaids are upfront costs you cover at closing, such as prepaid interest, property taxes, and homeowners insurance premiums.

How does my credit score affect my mortgage?

Your FICO score is used to assess how risky it is to lend you money. A higher score generally means you'll qualify for a lower interest rate and better loan terms.

What does it mean to get pre-approved for a mortgage?

Getting pre-approved means a lender has reviewed your finances and given you an estimate of how much you can borrow. This is a smart move before house hunting because it shows sellers you're a serious buyer.

What are the Loan Estimate and Closing Disclosure?

These are important documents you'll receive during the mortgage process. The Loan Estimate provides an early estimate of your loan terms, interest rate, and closing costs, while the Closing Disclosure gives you the final details of your loan before you sign on the dotted line.

FHA Loan Articles

October 24, 2024Buying your first home is a major milestone. If you use an FHA mortgage to buy your home, you’ll have two types of insurance to consider. One type is the FHA-required mortgage insurance premium, which is paid for 11 years or the loan's lifetime, depending on your down payment, loan term, and other variables.

October 22, 2024While the Federal Housing Administration sets rules for FHA loans, lenders retain some flexibility in determining interest rates, fees, and specific loan terms. Depending on circumstances, the FHA loan offered by your local bank might not be as competitive as one offered by a credit union or an online lender specializing in FHA products, or vice versa.

October 17, 2024Buying a home is one of the most significant investments Americans make. Understanding how to strengthen your credit profile and leverage the power of credit counseling is essential for successfully navigating the FHA loan process. What should you know about your credit to make the most of your home-buying journey?

March 13, 2024There are plenty of reasons to delay plans to refinance a home. One reason has made big headlines. When borrowers face higher interest rates than originally approved for, that is a good reason to wait to refinance.

February 12, 2024When you are approved for an FHA One-Time Close Construction loan, you get a single loan that pays for both the costs to build the house, and serves as the mortgage. One application, one approval process, and one closing date.