Fixing Your Credit Score

January 10, 2023

To start improving your credit score, it helps to know what goes into making it. The factors that affect your score are:

- Timely payments: 35%

- Overall debt: 30%

- Length of credit: 15%

- New credit applications: 10%

- Types of credit: 10%

Know Your Score

You need to know what your score is if you want to get started on improving it for a home loan. According to the Fair Credit Reporting Act, individuals have the right to their own credit report, which is available from a credit bureau. You can request your report from these bureaus, the top three of which are Equifax, TransUnion, and Experian. Once you have your report, you can review it and dispute any discrepancies. The bureaus are responsible for investigating any disputes within 30 days.

Don’t Let Your Balance Go Past-Due

The most important factor that makes up your credit score is your payment history. 35% of your credit report depends on whether or not you make payments on time. The later you are on those payments, the worse it is for your credit report. Always try to pay off your credit balances in full. Not only does this keep you from incurring large interest payments, but having a “paid in full” remark on your credit report looks good to lenders considering you for a loan.

Building a Credit History from Scratch

Many first-time homebuyers run into the problem of not having a sufficient credit history. This can affect the 15% of your score that depends on age of credit. Establishing credit history can start with signing up for a credit card and using it to pay for everyday items. It also helps to set up utility payments through your credit card online. Just remember to pay off the balance on time!

Be Proactive About Opening New Lines of Credit

When applying for a loan or credit card, your bank or lender performs a “hard inquiry.” This is a review of your credit that in turn affects your score. If you submit multiple credit applications in a short timeframe, it shows up as a red flag for lenders. They might assume that you aren’t handling your finances well enough if you need multiple lines of credit open at once. It’s important that you don’t submit credit applications close to the time that you apply for a home loan.

Remember that your credit score represents your creditworthiness. Based on this number, a lender determines whether you are a high-risk borrower and if it’s a smart idea to loan you a huge amount of money. It also determines the interest rate you’ll receive from the lender, so it is worth your time to work on increasing your score.

------------------------------

RELATED VIDEOS:

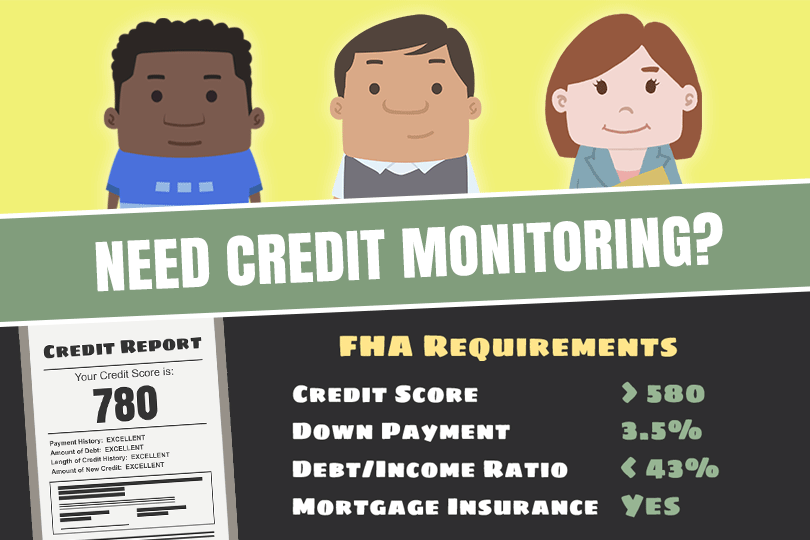

Learn How to Meet FHA Requirements

A Few Tips About Your Fixed Rate Mortgage

Your Proof of Ownership Is the Property Title

FHA Loan Articles

October 31, 2024When buying a home for the first time, it helps to know how long the process can take. How do you know if your appraisal report is delayed if you don’t know how long the FHA allows for the process to be completed? How long does it take to get from the final offer to closing day? A “typical” FHA loan process may take up to 45 days from start to finish. Several factors can influence this timeline.

October 30, 2024Just because an FHA loan is designed to be more lenient with FICO scores and require a lower down payment doesn’t mean the house you buy with that loan is less than ideal. Did you know that FHA loans have minimum property standards to ensure the home is safe and livable? Those standards require the home to have an “economic life” for the entire term of the loan so you can freely sell the property later on if you choose to do so.

October 29, 2024Buying a home with an FHA mortgage is a major life decision, and preparation is essential before you start house hunting or consider making an offer on a property.

How to get started? In the early stages, establishing your budget and how much work you need to do on your credit is key. But once you have gotten past the initial phase of that planning you’ll want to consider the house itself and what you want from it.

October 25, 2024Mixed-use properties combine residential and commercial spaces. Some borrowers applying for FHA home loans want to know if purchasing such a property using an FHA single-family home loan is possible. The FHA does allow the use of its loans for mixed-use properties, but certain conditions must be met.

October 24, 2024Buying your first home is a major milestone. If you use an FHA mortgage to buy your home, you’ll have two types of insurance to consider. One type is the FHA-required mortgage insurance premium, which is paid for 11 years or the loan's lifetime, depending on your down payment, loan term, and other variables.