Adjustable Rate Mortgage

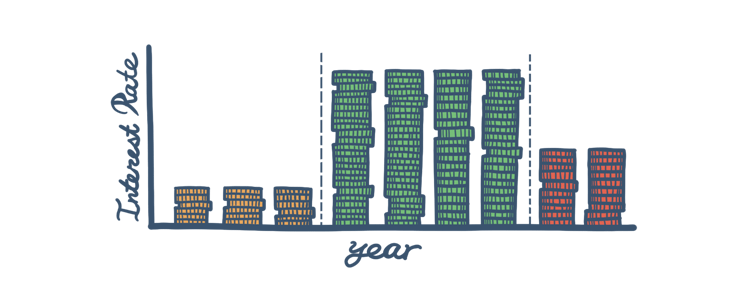

An adjustable-rate mortgage (ARM) has an interest rate that changes periodically through the life of the loan. ARMs come with an introductory period with a low, fixed rate. After this initial period, the interest rate applied to the outstanding balance varies based on the market index.

How the FHA ARM Works

The interest rate you get after the initial period is over is based on an index and your lender’s margin (which should be disclosed when you apply for the loan). The new interest rate is calculated by adding the margin to the index. As the index figure changes, so will your interest rate. The FHA accepts market index figures of the Constant Maturity Treasury (CMT) index or the 1-year London Interbank Offered Rate (LIBOR).

The idea of a large swing in the interest rates might make an ARM less appealing. That’s why the FHA places two types of caps, to provide a safeguard from astronomically high (or low) rates. There is an annual cap, which limits the points your interest rate can change year to year, and a “life-of-the-loan” cap that restricts the amount it can vary for the entire term of the loan.

FHA's ARM

The FHA has a few adjustable-rate mortgage options that can suit the needs of many borrowers. It offers a standard 1-year ARM and four "hybrid" ARM products, which have an initial interest rate that is fixed for the first 3, 5, 7, or 10 years. After that initial period, the interest rate adjusts annually.

The Pros

Choosing to finance a home with an ARM can work extremely well for some borrowers for a few reasons.

- Borrowers who intend to move and sell their home within a few years can take advantage of the low interest rates that come with the initial period of an adjustable-rate mortgage.

- Many homebuyers use the introductory period to save and budget for the future.

- Some borrowers may be expecting a significant increase in their income.

The Cons

It’s important to remember the downsides that come with the uncertainty of ARMs in order to make the best decision.

- There is always the chance that the index can go up drastically and your interest rate can skyrocket.

- When there is an uncertainty of how much you’ll be spending on monthly mortgage payments, budgeting isn’t as easy to do.

FHA Loan Articles

February 26, 2021Many Americans go with FHA loans because there are a number of mortgage programs that can fit different needs. These programs include FHA Fixed Rate Loans, FHA Adjustable Rate Mortgages, FHA One-Time Close Loans, FHA Condo Loans, and several others.

February 21, 2021The new year came with some changes being made in the mortgage industry, particularly when it comes to Adjustable- Rate Mortgages, or ARMs. The interest rate you get with an ARM is based on an index and a margin which is disclosed when you apply for the loan.

February 6, 2021As an existing homeowner, you may want to take advantage of falling interest rates by refinancing your current mortgage. For many homeowners, the thought of going through the refinancing process can be tiresome. But an FHA Streamline Refinance could help you avoid the extra work.

January 30, 2021As your closing day gets closer and closer, you might start to feel a little nervous. Do you have everything you need? Will something delay the closing? These worries are natural, but the more prepared you are, the less overwhelming it will all seem.

January 16, 2021What you may not know that there are many different types of refinances and different benefits that come with them. The cash-out refinance, or cash-out refi, is one that many borrowers opt for, for several reasons.