FHA Refinance Loans

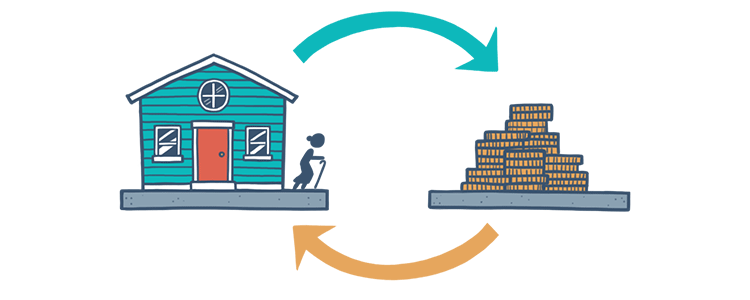

There are a number of reasons that homeowners decide to refinance their homes. You might want to take advantage of low interest rates to decrease your monthly mortgage payments. Or it might be you simply want to put your home equity to work by making upgrades. Whatever the reason, there's likely to be a suitable FHA Refinance option available that works with your goals.

The FHA offers a "streamlined" refinancing option that allows current FHA borrowers to reduce the interest rate on their home loans quickly and oftentimes without an appraisal. FHA Streamline Refinances cut down on the amount of paperwork that must be completed by lenders saving valuable time and money.

A cash-out refinance lets existing homeowners to use the equity they've already accumulated on their home. To be eligible for an FHA Cash-Out Refinance, FHA borrowers must have at least 20% equity in the property based on a new appraisal.

A Simple Refinance allows a homeowner lower the interest rate on their current FHA loan, whether it's a fixed-rate loan or an ARM. The refinance is straightforward, requiring a credit qualification, income, and assets to ensure the borrower meets the new loan requirements.

The FHA 203(k) loan lets you refinance your home and use the cash funds to make repairs and upgrades to it, or to "rehabilitate" it. The FHA's Rehabilitation Loan can also be used to finance the purchase of an older, "fixer-upper" house at a low price.

The FHA's Home Equity Conversion Mortgage, commonly known as a reverse mortgage, is for homeowners above the age of 62 who are looking to use some of the equity they've amassed on their home. This loan is not repaid until the home is sold or the borrower dies.

FHA Loan Articles

April 3, 2021Borrowers can choose to refinance for several reasons, but it comes down to prioritizing different benefits. One homeowner may want the lowest possible monthly payment, while another might want the shortest possible term for their loan.

March 15, 2021A key step in the mortgage process is the home appraisal. In the case of home purchase or refinance, this is a task that is almost always required by the lender, and it is important that potential homebuyers understand what, how, and why of a home appraisal.

March 6, 2021When buying a home, you have a list of things you need to do. Get pre-approved, arrange for a home inspection, and a few other tasks. One important thing on that list is shopping for homeowner’s insurance.

February 26, 2021Many Americans go with FHA loans because there are a number of mortgage programs that can fit different needs. These programs include FHA Fixed Rate Loans, FHA Adjustable Rate Mortgages, FHA One-Time Close Loans, FHA Condo Loans, and several others.

February 6, 2021As an existing homeowner, you may want to take advantage of falling interest rates by refinancing your current mortgage. For many homeowners, the thought of going through the refinancing process can be tiresome. But an FHA Streamline Refinance could help you avoid the extra work.

January 30, 2021As your closing day gets closer and closer, you might start to feel a little nervous. Do you have everything you need? Will something delay the closing? These worries are natural, but the more prepared you are, the less overwhelming it will all seem.