FHA Refinance Loans

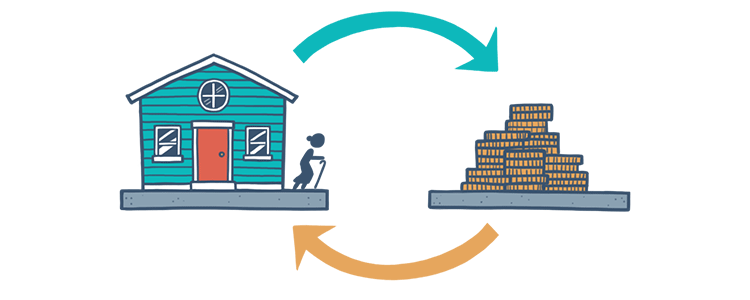

There are a number of reasons that homeowners decide to refinance their homes. You might want to take advantage of low interest rates to decrease your monthly mortgage payments. Or it might be you simply want to put your home equity to work by making upgrades. Whatever the reason, there's likely to be a suitable FHA Refinance option available that works with your goals.

The FHA offers a "streamlined" refinancing option that allows current FHA borrowers to reduce the interest rate on their home loans quickly and oftentimes without an appraisal. FHA Streamline Refinances cut down on the amount of paperwork that must be completed by lenders saving valuable time and money.

A cash-out refinance lets existing homeowners to use the equity they've already accumulated on their home. To be eligible for an FHA Cash-Out Refinance, FHA borrowers must have at least 20% equity in the property based on a new appraisal.

A Simple Refinance allows a homeowner lower the interest rate on their current FHA loan, whether it's a fixed-rate loan or an ARM. The refinance is straightforward, requiring a credit qualification, income, and assets to ensure the borrower meets the new loan requirements.

The FHA 203(k) loan lets you refinance your home and use the cash funds to make repairs and upgrades to it, or to "rehabilitate" it. The FHA's Rehabilitation Loan can also be used to finance the purchase of an older, "fixer-upper" house at a low price.

The FHA's Home Equity Conversion Mortgage, commonly known as a reverse mortgage, is for homeowners above the age of 62 who are looking to use some of the equity they've amassed on their home. This loan is not repaid until the home is sold or the borrower dies.

FHA Loan Articles

November 2, 2021Interest rates started to decline in 2019 and still seem considerably low. The average rate for a 30-year, fixed rate home loan has fallen from 4.94% in November 2018 to 3.13% in October 2021. A point drop in your interest rate could translate to huge savings with each monthly payment

October 30, 2021The FHA Rehabilitation Loan program allows lenders to cover the purchase or refinance, as well as the rehabilitation of the home, as part of a single mortgage. This loan can be used to finance a property that is at least one year old with a total cost of repairs amounting to at least $5,000

July 30, 2021The FHA Streamline Refinance allows mortgage holders to refinance their home loan without going through the process of second appraisal. Since this is a step that was completed with the first FHA mortgage, the FHA waives it for the refinance

July 14, 2021Making the decision to buy a house is a big one, followed by the choice of which house to buy. The next biggest decision you make is going to be the type of home loan you need to go through with the purchase. One option for financing your home is an FHA loan.

May 24, 2021With historically low interest rates, the mortgage industry has seen a sharp uptick in refinances. Taking advantage of the current market might be in your best interest and could lower your monthly payment significantly. Don’t forget that refinancing a mortgage comes with closing costs.

April 11, 2021With the trend of falling interest rates since 2019, the number of mortgage refinances around the country has spiked and continues to rise. Borrowers with FHA loans can also capitalize on the low rates, but it may be possible to simplify the process with the FHA Streamline Refinance.