Should You Pay Extra to Lower Your FHA Loan Interest Rate?

April 29, 2025

The idea behind discount points is a straightforward exchange: you spend money today to reduce your interest rate. Typically, one point equals one percent of your total FHA loan. In return, your interest rate might decrease by an amount you and the lender agree upon.

Whether this trade-off works in your favor depends on your intended length of homeownership.

Life is unpredictable. Career changes, family growth, or simply a desire for a different environment can lead to a move sooner than anticipated.

If you sell or refinance your loan before reaching the "break-even point" – the moment your cumulative savings from lower payments equal the initial cost of the points – you'll end up in the red.

If your future in the home feels less than certain, that upfront investment in discount points becomes a risky bet.

The money you'd spend on discount points could serve more pressing needs. Perhaps you need a more robust emergency fund, or you have other investment opportunities you want to pursue.

FHA loans are attractive partly because they often require a smaller down payment. However, if you deplete a significant portion of your remaining savings to shave off a tiny bit of interest, you might leave yourself financially vulnerable for unexpected expenses.

The savings from a slightly lower interest rate might pale compared to the total loan cost, including the mandatory mortgage insurance. It depends on your long-term plans.

In such situations, prioritizing cash flow and minimizing immediate outlays often makes more sense.

The current interest rate environment plays a role in this decision. Are interest rates already relatively low at the time? In such cases, the potential savings you'll gain by purchasing discount points might be minimal.

- It could take a very long time for your reduced monthly payments to add up to the money you spent on the points.

- Conversely, in a high-interest-rate market, buying points might be a more compelling option for someone committed to staying in the home long-term.

- Does paying for discount points align with your short-term and long-term financial goals? Are you confident in your long-term plans for the property?

- How comfortable are you with parting with the cash upfront at closing time?

FHA Loan Articles

May 20, 2025If you are buying a home with an FHA mortgage, you’ll want to learn how the Federal Housing Administration (FHA) addresses termite and other wood-destroying pest issues that might be associated with the new property. How much do you know about termites and other wood-destroying pests? You could save time and money by knowing key details ahead of time.

May 19, 2025When you get ready to commit to buying your dream home, the FHA appraisal is necessary to make certain the house you want is suitable for the loan and to know its actual fair market value. Is it in good repair? Does it have termites or other pests? Is it near a high-noise environment like an airport or bus terminal? There are many issues to consider, and the FHA appraisal process is designed to address them, as we'll explore.

May 14, 2025When you buy a home with an FHA mortgage, you must pay for both mortgage insurance and insurance to protect your property while paying on the loan. There are important nuances to these insurance policies to know before you start. What's the difference between insurance against water damage and flood insurance? That's just one example of the "hidden" expenses of buying your new home to budget for.

May 13, 2025Buying a home with an FHA mortgage means you'll need to know the FHA guidelines about the types of properties you can purchase with an FHA single-family home loan for residential purposes. How well do you understand these rules? Are you truly ready to start house hunting? We examine some key aspects of the process.

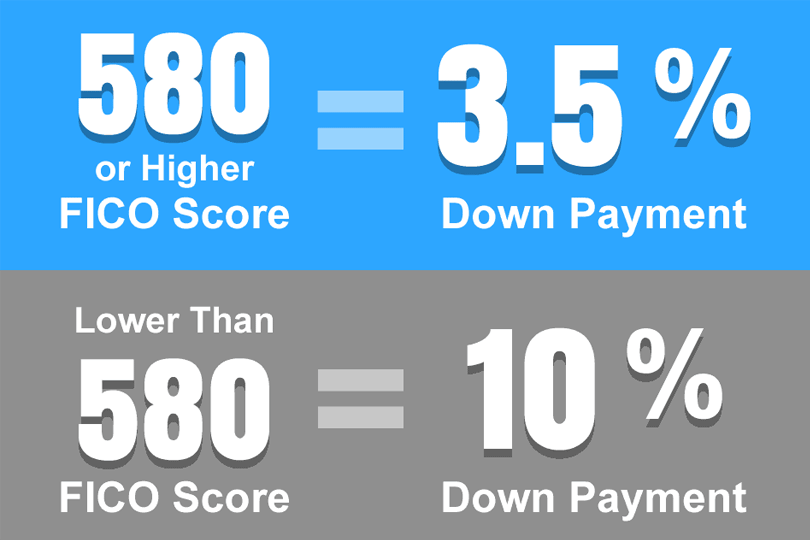

May 12, 2025FHA single-family home loans require a minimum 3.5% down payment for typical transactions. Saving for this requires planning and dedication, but it’s not impossible to save enough to make the down payment. How do people typically budget and save for this? Your financial needs and goals will play a big role in how much you decide to set aside for your new home, but here are some options to think about...