Can I Get a No Money Down FHA Loan?

August 14, 2023

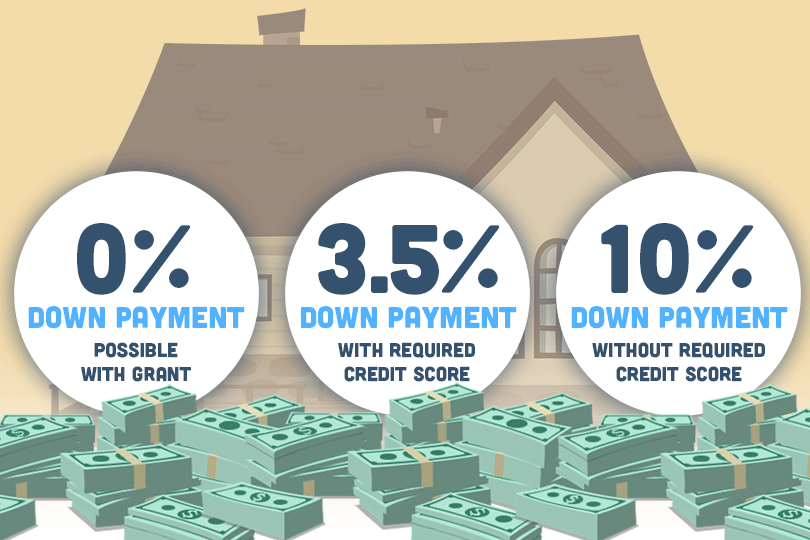

FHA loans typically require a minimum down payment of 3.5% of the purchase price of the home with the right credit score. This means that if you're buying a house for $240,000, you would need to make a down payment of at least $8,400. The down payment can come from your own funds, a gift from a family member, or a down payment assistance program. If your credit score is below the standard requirement set by you lender you may have to increase your down payment to 10% of the loan.

It's important to note that while the down payment requirement for FHA loans is relatively low, you will still need to cover closing costs, which can include fees for appraisals, inspections, title insurance, and more. These costs are separate from the down payment.

Additionally, FHA loans have mortgage insurance premiums (MIP) that borrowers are required to pay, both upfront and as part of their monthly mortgage payments. This insurance helps protect the lender in case the borrower defaults on the loan.

Please keep in mind that loan program guidelines can change over time, so it's a good idea to consult with a mortgage lender or FHA-approved lender for the most up-to-date information on FHA loan options and requirements, especially if you are considering purchasing a home today.

------------------------------

RELATED VIDEOS:

Annual Income Requirements for FHA Loans

Good Credit History Helps Get FHA Loans

Stay Informed About Your Mortgage Closing Costs

FHA Loan Articles

September 8, 2023Borrowers considering an FHA loan should be familiar with some basic loan terminology. These loans are popular among first-time homebuyers and those with lower credit scores because they often offer more flexible eligibility requirements and lower down payment options.

September 2, 2023You may have heard the terms co-borrower and cosigner in connection with your FHA loan process, but aren't sure about the distinction. Both a co-borrower and a cosigner can help a primary borrower qualify for a mortgage, but they have different roles and responsibilities.

August 27, 2023The Federal Housing Administration has specific credit requirements and guidelines for borrowers looking to buy or refinance homes with an FHA loan. In addition to what FHA guidelines state, lenders may have more stringent requirements that may vary from one lender to another.

August 23, 2023Mortgage APR (Annual Percentage Rate) and a loan's interest rate are two different things, although they are closely related. Understanding the difference is an important part of a borrower's analysis of the true cost of their mortgage.

August 19, 2023FHA refinance loans allow homeowners with existing FHA loans to refinance their mortgages. These loans are designed to help borrowers take advantage of lower interest rates, reduce their monthly mortgage payments, or access equity in their homes for various purposes.