FHA Loans: America's Favorite Mortgage

What appeals to many first-time homebuyers about FHA loans are the lenient eligibility requirements. But whether you're buying your first home, or just moving to a new one, the FHA loan program can help you finance a home with low down payments and flexible guidelines.

A popular FHA program is the fixed-rate mortgage, in which the interest rate remains the same through the term of the loan. With this constant interest rate, monthly payments don't change. Fixed-rate mortgages come with terms of 15 or 30 years.

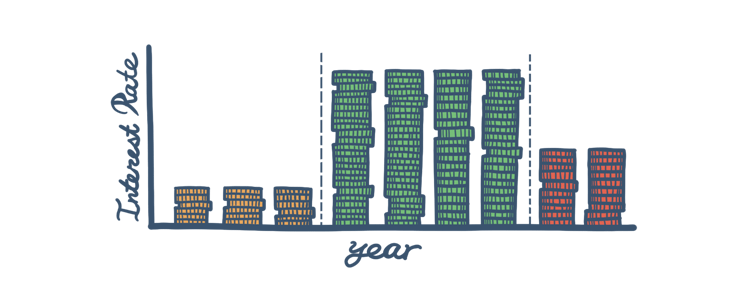

Adjustable-rate mortgages have an interest rate that—after an introductory period—varies for the life of the loan. The interest rate changes annually, going higher or lower, reflecting the fluctuating market indices approved by the FHA. The FHA has a few adjustable-rate mortgage options that can suit the needs of many borrowers.

This construction loan is an FHA program that finances the lot purchase, construction, and permanent loan of a new home in a single mortgage. You need only qualify once and pay a single set of closing costs. Your fixed-interest rate is locked in and the entire loan is in place before construction on your new home begins.

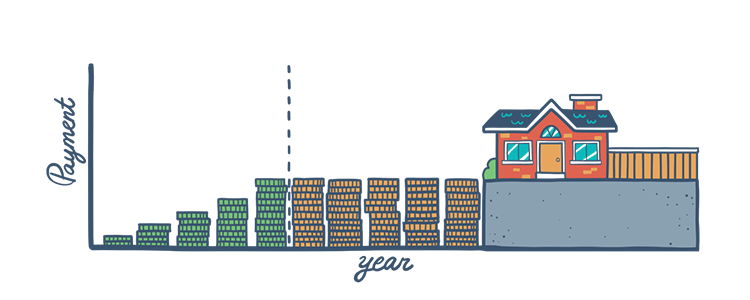

The FHA offers this type of loan to borrowers who expect their income to increase. The Graduated Payment Mortgage initially has low monthly payments that then gradually increase according to one of five available plans, which have varying lengths and rates.

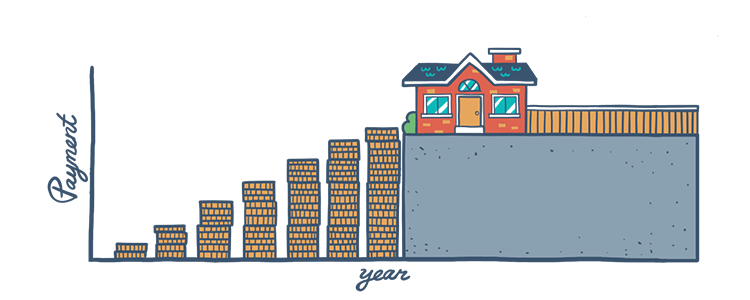

Growing Equity Mortgages (GEMs) are part of the FHA's Section 245(a) loan type that start off with lower initial payments, and increase according to a predetermined schedule over the life of the loan.

The FHA's Energy Efficient Mortgage program (EEM) finances energy-efficient home improvements for FHA borrowers. This helps homebuyers save money on household utility bills so that they can afford to make monthly payments on their home mortgage.

The FHA helps finance the purchase of condominiums with what is called a Section 234(c) loan. This loan can have a term of up to 30 years. It is primarily for residential condos that have at least two units and are located in an FHA-approved condominium projects.

FHA Loan Articles

June 25, 2021Most first-time homebuyers decide on purchasing a home at least a year in advance, sometimes even a couple of years ahead of time. The earlier you make a decision to buy a home, the more time you have to save up for your down payment.

May 24, 2021With historically low interest rates, the mortgage industry has seen a sharp uptick in refinances. Taking advantage of the current market might be in your best interest and could lower your monthly payment significantly. Don’t forget that refinancing a mortgage comes with closing costs.

May 8, 2021With a new waiver in place, Dreamers have access to affordable FHA home loans designed for first-time homebuyers. There is no discrepancy in the FHA’s eligibility requirements when it comes to DACA status holders applying for an FHA-backed mortgage. They must meet all the same criteria.

April 30, 2021Buying a house is overwhelming to begin with. Make it a seller’s market, and buyers become even more nervous. Supply of real estate has been low for most of 2021, in part because of the Coronavirus pandemic and the historically low interest rates since 2019.

April 23, 2021No matter what kind of market you’re in, it is always best to get pre-approved before going to shop for houses. The last thing you want is to go look at homes, find the one you love, then have to wait on an approval and lose the dream home to another buyer.

April 11, 2021With the trend of falling interest rates since 2019, the number of mortgage refinances around the country has spiked and continues to rise. Borrowers with FHA loans can also capitalize on the low rates, but it may be possible to simplify the process with the FHA Streamline Refinance.