FHA Loans: America's Favorite Mortgage

What appeals to many first-time homebuyers about FHA loans are the lenient eligibility requirements. But whether you're buying your first home, or just moving to a new one, the FHA loan program can help you finance a home with low down payments and flexible guidelines.

A popular FHA program is the fixed-rate mortgage, in which the interest rate remains the same through the term of the loan. With this constant interest rate, monthly payments don't change. Fixed-rate mortgages come with terms of 15 or 30 years.

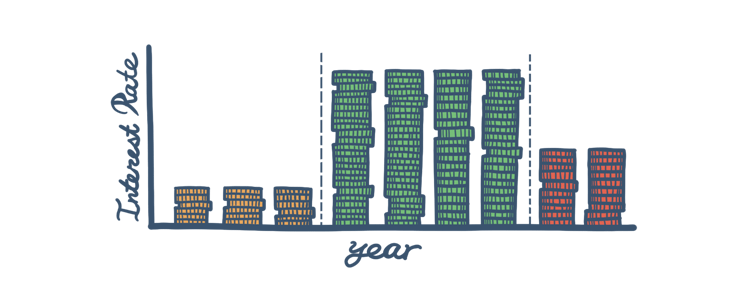

Adjustable-rate mortgages have an interest rate that—after an introductory period—varies for the life of the loan. The interest rate changes annually, going higher or lower, reflecting the fluctuating market indices approved by the FHA. The FHA has a few adjustable-rate mortgage options that can suit the needs of many borrowers.

This construction loan is an FHA program that finances the lot purchase, construction, and permanent loan of a new home in a single mortgage. You need only qualify once and pay a single set of closing costs. Your fixed-interest rate is locked in and the entire loan is in place before construction on your new home begins.

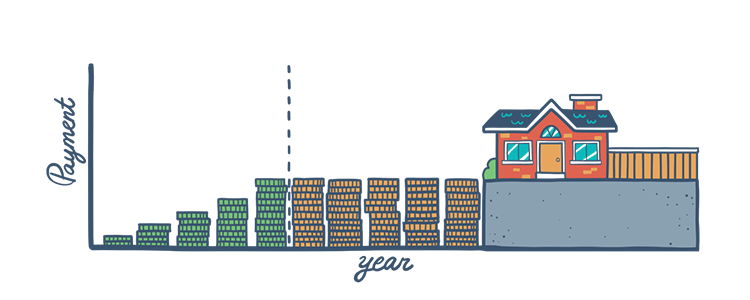

The FHA offers this type of loan to borrowers who expect their income to increase. The Graduated Payment Mortgage initially has low monthly payments that then gradually increase according to one of five available plans, which have varying lengths and rates.

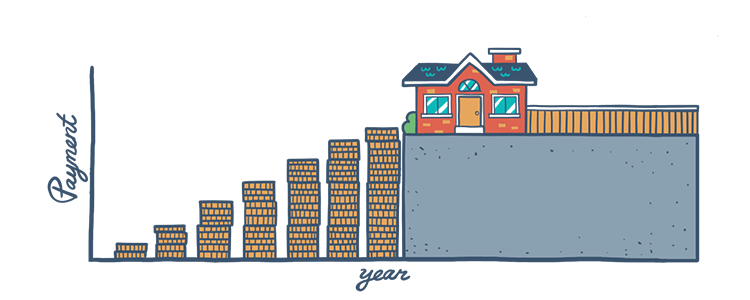

Growing Equity Mortgages (GEMs) are part of the FHA's Section 245(a) loan type that start off with lower initial payments, and increase according to a predetermined schedule over the life of the loan.

The FHA's Energy Efficient Mortgage program (EEM) finances energy-efficient home improvements for FHA borrowers. This helps homebuyers save money on household utility bills so that they can afford to make monthly payments on their home mortgage.

The FHA helps finance the purchase of condominiums with what is called a Section 234(c) loan. This loan can have a term of up to 30 years. It is primarily for residential condos that have at least two units and are located in an FHA-approved condominium projects.

FHA Loan Articles

October 17, 2022If you’ve begun your search for a new home and are looking into mortgage options, you’ve likely heard of mobile, manufactured, and modular homes. While people working in real estate throw these terms around easily, it might be something that leaves everyday homebuyers confused.

September 17, 2022The FHA sets these limits annually according to the location and type of home, and it represents the maximum loan amount the agency will insure. Approved FHA-lenders can set their own requirements in addition to the FHA’s criteria for borrowers, such as higher credit scores.

June 16, 2022It’s a great option to consider if you want to build your dream home on your own land instead of buying someone else’s already-lived-in house. FHA One-Time Close mortgages are also referred to as single-close construction loans--you’ll see these terms used interchangeably.

May 7, 2022The appraisal process is a very important part of buying a home. When you are budgeting and planning for your loan, you may want to set aside some extra funds in case there are corrections required as the result of an appraisal.

April 12, 2022There is a major question some new borrowers have about home loans in general, that also applies to construction loans in particular. If you want to apply for an FHA One-Time Close construction loan, there are certain rules about loan funding that you should know about.

March 30, 2022Once you’ve decided that you’ll be purchasing a home, one of the first questions you need to ask yourself is what kind of mortgage you’ll be using to finance it. When it comes to shopping for a home loan, there are a number of options to consider.