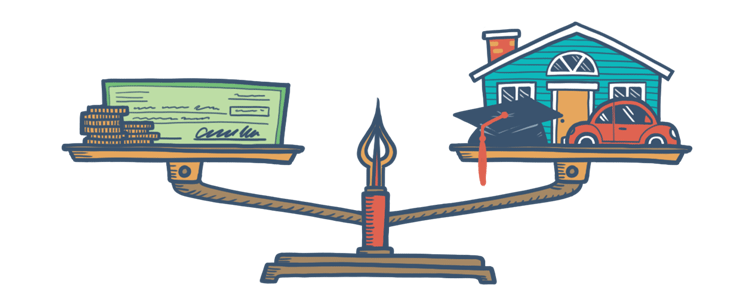

Debt-to-Income Ratios

If FHA borrowers start to default on their homes, it defeats the main purpose of the FHA. That's why there are certain criteria in place to ensure that homebuyers are not signing up for home loans that they cannot reasonably afford and pay back. Since the FHA has no minimum income requirement, it relies on the borrowers' debt-to-income ratio to determine whether they have the means to make monthly payments.

What Are Debt Ratios?

Your debt-to-income ratio (also called a debt ratio) gives lenders a clear picture of how much you owe each month to how much you earn. The debt ratio is calculated by dividing the sum of your monthly debts and dividing it by your total assets.

For your monthly debt, the FHA take into account all the money you owe: credit card or lines of credit payments, car payments, student loan payments, taxes, insurance, alimony and child support, as well as the amount of your potential new house payment. Your pre-tax income, wages, tips, child support, social security, amounts to your total monthly assets. The number you arrive at after dividing your total debt by assets is your debt-to-income ratio.

The FHA's Debt Ratio Limits

According to HUD Handbook 4000.1, FHA borrowers can have a “maximum qualifying ratio” 43%. Add up the total mortgage payment for your potential new home (principal and interest, escrow deposits for taxes, hazard insurance, mortgage insurance premium, homeowners' dues, etc.) as well as your recurring monthly debt (car loans, personal loans, student loans, credit cards, etc.). Then divide that amount by your gross monthly income. That number should fall under 43% to qualify.

Many borrowers may have a high enough credit score to qualify for FHA loans and be able to make the down payment as well. But your debt-to-income ratio plays a big role in a lender determining whether you should be granted a loan. A good credit report is important, and it shows lenders that you have a history of making payments on time. But a debt ratio that's too high tells them that you have high monthly expenses compared to how much money you earn and that you might not be the best at budgeting.

The FHA makes some discretionary exceptions for borrowers with debt ratios higher than 43% based on certain “compensating factors.” Borrowers who have higher credit scores, verified cash reserves, or Energy Efficient homes might be granted a loan despite higher debt-to-income ratios.

FHA Loan Articles

April 23, 2021No matter what kind of market you’re in, it is always best to get pre-approved before going to shop for houses. The last thing you want is to go look at homes, find the one you love, then have to wait on an approval and lose the dream home to another buyer.

April 11, 2021With the trend of falling interest rates since 2019, the number of mortgage refinances around the country has spiked and continues to rise. Borrowers with FHA loans can also capitalize on the low rates, but it may be possible to simplify the process with the FHA Streamline Refinance.

March 29, 2021The FHA helps first-time and low-income homebuyers by having lower down payment requirements for its borrowers. Despite this lower credit eligibility criteria set by FHA, it is important to remember that FHA-approved lenders can set their own requirements

March 24, 2021One of the major arguments people have for renting instead of buying is the large upfront cost of a down payment. Depending on the type of loan program you apply and are approved for, this could mean anything between 3.5% and 20% percent of your purchase price.

March 21, 2021The two basic types of home loans are fixed rate and adjustable-rate mortgages. The mortgage market offers many other options to homebuyers, but these two are the most common, and the first pair from which to pick.

March 15, 2021A key step in the mortgage process is the home appraisal. In the case of home purchase or refinance, this is a task that is almost always required by the lender, and it is important that potential homebuyers understand what, how, and why of a home appraisal.