FHA Loans, New Borrowers, And Credit

November 27, 2024

FHA Loans And Credit Scores

What follows is not financial advice. Always consult a finance or tax professional for the most current information.

While FHA loans offer more lenient credit score requirements, establishing a positive credit history is still vital in loan approval. You’ll need to know what your lender will see in your credit report long before you submit that information to them. How many credit mistakes are too many for your lender?

There is no set metric, but to understand how the lender thinks, remember that they have to justify approving your loan based on the information in your reports. Does the data in them make it easier or harder for the lender to say yes?

Lenders use credit reports to assess borrowers' creditworthiness and history of managing debt. Managing your financial obligations is a big part of loan approval. If you need to work on your credit, there are several ways to do so before a home loan application. Start working on these issues a year in advance at a minimum.

Building Credit

Several strategies exist for building credit. Secured credit cards, which require a security deposit, can help, but you will need time to build up your credit patterns with the new card.

Responsible use of a secured card can help build credit over time, as can credit-builder loans, which involve borrowing a small amount of money held in a savings account until the loan is repaid.

The activity on these loans is typically reported to credit bureaus, helping establish a credit history.

Consider becoming an authorized user on a responsible family member or friend's credit card. This, too, can help build credit since the account's payment history may be reported to credit bureaus.

Making consistent and on-time student loan payments demonstrates responsible debt management and contributes to a positive credit history. Some services allow renters to report their rent payments to credit bureaus, which can help establish a credit history.

Read Your Credit Reports

Request a free credit report from Equifax, Experian, and TransUnion. You are entitled to a free report annually to review for accuracy and identify problems.

Did you find errors or inaccuracies on your credit report? Dispute them immediately and set up credit monitoring services to track your credit score and stay informed of any changes.

FHA Loan Articles

May 7, 2022The appraisal process is a very important part of buying a home. When you are budgeting and planning for your loan, you may want to set aside some extra funds in case there are corrections required as the result of an appraisal.

April 12, 2022There is a major question some new borrowers have about home loans in general, that also applies to construction loans in particular. If you want to apply for an FHA One-Time Close construction loan, there are certain rules about loan funding that you should know about.

March 30, 2022Once you’ve decided that you’ll be purchasing a home, one of the first questions you need to ask yourself is what kind of mortgage you’ll be using to finance it. When it comes to shopping for a home loan, there are a number of options to consider.

March 3, 2022Savvy homeowners make it a point to monitor interest rates so they can take advantage of a drop. Many choose to refinance their mortgages to capitalize on falling rates and lower their monthly payments and save on interest.

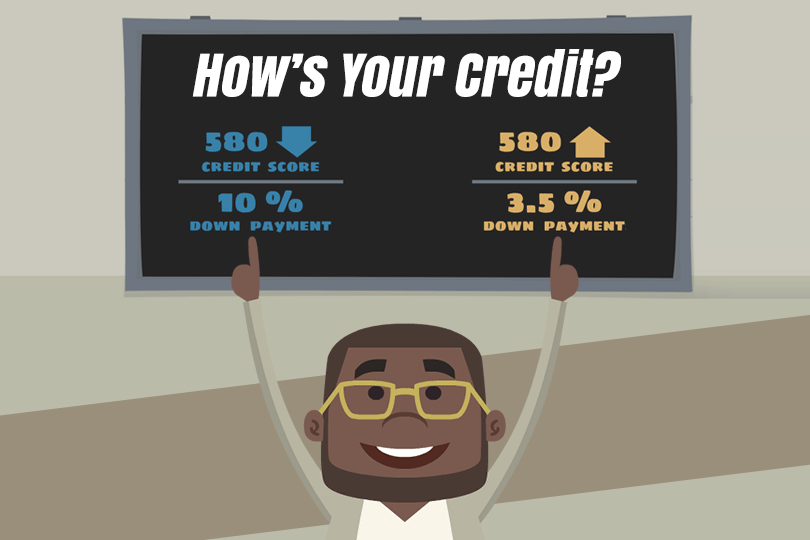

February 24, 2022One of the major hurdles that keeps families from purchasing a home is the need for a down payment. The FHA’s goal is to offer more homebuying opportunities to low- and moderate-income Americans and set more easily achievable down payment requirements for borrowers.