Credit Matters: What to Know Before Applying for a Home Loan

October 17, 2024

Buying a home is one of the most significant investments Americans make. Understanding how to strengthen your credit profile and leverage the power of credit counseling is essential for successfully navigating the FHA loan process.

What should you know about your credit to make the most of your home-buying journey? We examine some key points below.

Why Credit Matters for FHA Loans

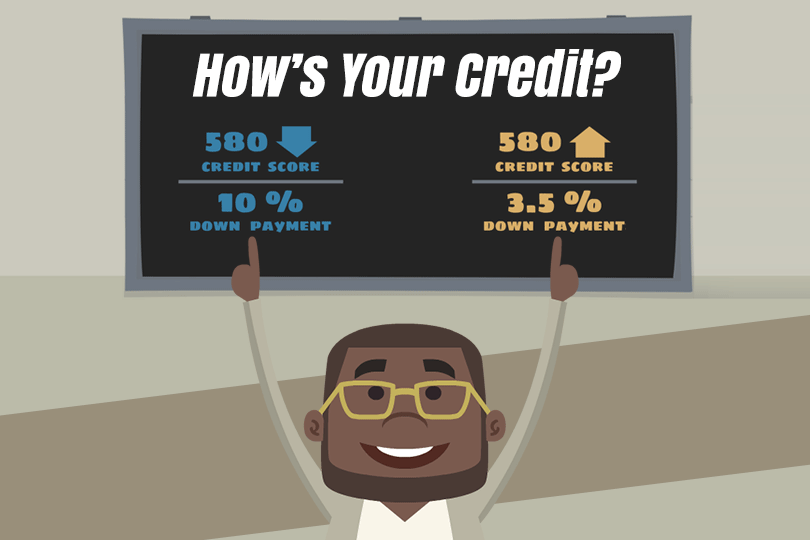

While FHA loans are known for their flexibility, your credit score is a major factor in the application process. FICO scores indicate your financial responsibility and ability to manage debt.

Your Credit Score: A Breakdown Of Lender Priorities

- Payment History (35%): Some believe payment history is one of the most influential credit factors. Lenders want a consistent history of on-time payments for all financial obligations.

- Amounts Owed (30%): Your credit utilization ratio (the percentage of available credit you use) is another critical factor. High credit utilization can signal financial strain and negatively impact your score. An ideal credit utilization ratio? Below 30%, preferably below 10%.

- Length of Credit History (15%): A longer credit history, in theory, shows greater financial responsibility. Lenders will look at the age of your oldest account and reference the average age of all the accounts in your name, as well as how recently you've used your credit.

- Credit Mix (10%): In some cases, having a diverse mix of credit options is a good sign. Having credit cards, installment loans, and mortgages may positively influence your score.

- New Credit (10%): Quickly opening multiple new credit accounts is not a good idea. Doing so may lower your FICO scores. The reason? A credit application triggers a "hard inquiry" on your credit report, which can be seen as a sign of increased risk.

7 Actionable Steps to Elevate Your Credit for an FHA Loan

1. Obtain and Scrutinize Your Credit Report

Request a free credit report from Equifax, Experian, and TransUnion. You can do this through AnnualCreditReport.com. The credit bureaus must provide you with one free report a year. Thoroughly review each report for errors, inaccuracies, or outdated information. Dispute any discrepancies with the respective credit bureau, providing supporting documentation as needed.

2. Prioritize On-Time Payments

Do not miss payments for any bills, including credit cards, utilities, loans, and rent. Set up automatic payments. Or use reminders to avoid late payments, which can significantly damage your credit. If you've had late payments in the past, focus on establishing a consistent pattern of on-time payments moving forward.

3. Strategically Manage Credit Card Balances

Work to get your credit utilization ratio below 30% on each card and on all other accounts. Prioritize paying down high-interest credit cards first. Consolidating multiple credit card balances into a single lower-interest loan may be a good option. Doing so can simplify payments and potentially reduce interest costs.

4. Exercise Caution with New Credit Applications

Avoid applying for new credit. Each hard inquiry can slightly lower your score, especially if you have several within a short time frame. If you need new credit, consider applying for a secured credit card. These cards require a security deposit that serves as your credit limit.

5. Preserve Your Credit History

Avoid closing old credit accounts, even if you no longer use them. Closing old accounts may affect your credit history and reduce your available credit. If you have an old account with a negative history, consider contacting the creditor to see if they offer goodwill adjustments to remove the negative mark.

6. Leverage Authorized User Status

If you have limited credit history or are rebuilding your credit, becoming an authorized user on a responsible person's credit card account can be beneficial. Ensure the account has a low credit utilization ratio and a history of on-time payments. Some credit scoring models don't give as much weight to authorized user accounts, an important variable to remember.

7. Explore Secured Credit Cards

Secured credit cards can help you establish credit or rebuild your score. Use your secured card responsibly, make small purchases, and pay your balance in full and on time each month. Some secured cards allow you to upgrade to an unsecured card after responsible use.

FHA Loan Articles

January 20, 2025The FHA Streamline Refinance offers a refinance option for those who don't want to cash in on their property's equity but instead want a lower payment or interest rate or who need to get out of an adjustable-rate mortgage. This streamlined program, designed specifically for those already in an FHA-insured mortgage, simplifies the refinancing process with fewer requirements and faster approval times depending on the transaction.

January 16, 2025Want to buy a home and thinking about getting an FHA loan? FHA loans are a great way to make homeownership happen, especially if you're a first-time buyer or don't have perfect credit. But you might wonder, "Can I get more than one FHA loan?"

The short answer is, it's tricky. The FHA itself doesn't say no automatically to having more than one loan. But there's a caveat. FHA loans are about helping you buy a place to live in – your main home base. Because of this, and a few other things, getting multiple FHA loans isn't easy.

January 15, 2025Buying a condo with an FHA loan is an option some don’t consider initially, but it’s worth adding to your list of potential property types. FHA loans for condo units traditionally require condo projects to be on or added to the FHA-approved list. Still, changes in policy over the years allow borrowers to apply for FHA loans on condo units in projects not on the list on a case-by-case basis.

December 30, 2024When applying for an FHA loan, lenders will consider more than just your credit scores and history. They also look at other factors affecting your risk profile and the interest rate they offer you.

One factor is occupancy type. For FHA loans, this is straightforward because these loans require owner occupancy. Investment properties aren't eligible. While conventional loans may have different rates for primary residences, second homes, and investment properties, this isn't a concern with FHA loans.

December 18, 2024Did holiday spending get the better of you? Are you looking for ways to recover your spending plan as you search for a new home?

The holidays are a whirlwind of festivities, family gatherings, and gift-giving. But amidst the cheer, it's easy to lose track of spending. If you're aiming to buy a home in the near future, those extra expenses can have a bigger impact than you might realize, especially if you're considering an FHA loan.