What to Know About the FHA Handbook

September 19, 2023

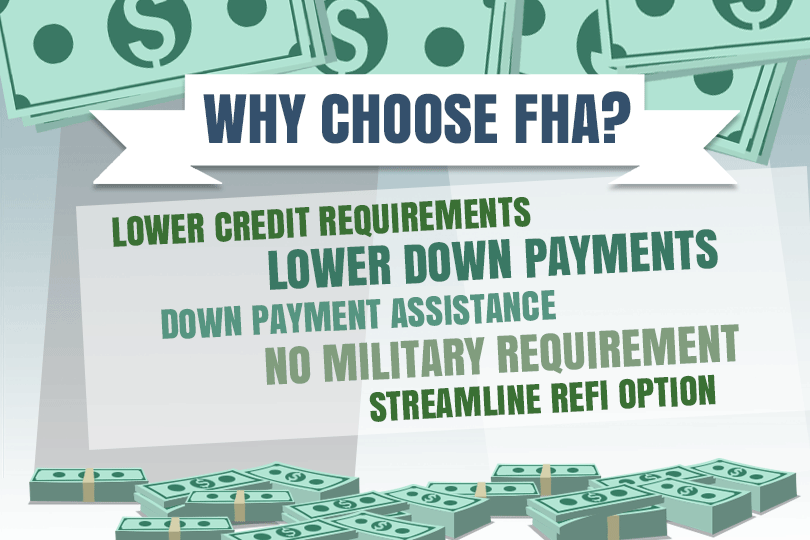

The FHA Handbook outlines the policies and requirements for FHA-insured mortgages, which are popular among first-time homebuyers and borrowers with lower credit scores or smaller down payments. It provides detailed instructions and guidelines on various aspects of the FHA loan program, including eligibility criteria, underwriting standards, property appraisal requirements, and mortgage insurance.

Key components covered in the FHA Handbook include:

Eligibility Requirements

The handbook explains who is eligible for an FHA loan, including minimum credit score requirements, debt-to-income ratios, and down payment guidelines.

Property Standards

It describes the property requirements that must be met for a home to qualify for FHA financing. This includes guidelines for the condition and safety of the property.

Appraisal Guidelines

The FHA Handbook outlines the specific requirements for property appraisals, ensuring that the property's value is accurately determined.

Credit Underwriting

It provides guidance on how lenders should assess the creditworthiness of FHA loan applicants, including requirements for handling credit issues and disputes.

Mortgage Insurance

Details on FHA mortgage insurance premiums, including both upfront and annual premiums, are included.

Closing and Settlement Costs

Information on allowable and non-allowable fees and costs for the borrower, as well as the seller's contributions.

Loan Origination and Processing

Guidelines for the processing of FHA loan applications, including required documentation and borrower verification.

Servicing and Loss Mitigation

Information on loan servicing requirements and how to handle delinquencies and foreclosures.

The FHA Handbook is periodically updated to reflect changes in FHA policies and industry best practices. Lenders and other professionals involved in FHA lending are required to adhere to the guidelines outlined in the handbook to ensure that loans meet FHA standards and qualify for FHA insurance.

------------------------------

RELATED VIDEOS:

There's a Difference Between APR and Interest Rates

Choose Your Mortgage Lender Carefully

Getting Started With Your FHA Loan Application

FHA Loan Articles

June 27, 2023The FHA loan process is straightforward and has been successfully navigated by millions of homeowners. If you're considering an FHA loan to finance your home purchase, it pays to be prepared. To avoid mistakes before you start your loan application, homebuyers should keep these tips in mind.

June 20, 2023Can an FHA loan be approved if there are late or missed payments on the credit report? Navigating through financial challenges, such as escalating costs of living and employment uncertainties, can indeed make it difficult to maintain a perfect financial record.

June 15, 2023When you buy a home with an FHA mortgage, cash for closing costs and your down payment is required. It would be easy to assume you simply give the lender cash in the specified amount and that’s the end of the story.

May 20, 2023Did you know there is an FHA loan option that lets you build a house from the ground up? You can use this mortgage to build on land you own or on land you buy as part of the loan. But you will want to address some issues comparing construction loan options.

May 3, 2023Sometimes when buying a home there may be a question of surplus or excess land. You likely won’t face this issue when buying a condo unit, but for other types of purchases, this may be an important factor in the appraisal process.