Should You Pay Extra to Lower Your FHA Loan Interest Rate?

April 29, 2025

The idea behind discount points is a straightforward exchange: you spend money today to reduce your interest rate. Typically, one point equals one percent of your total FHA loan. In return, your interest rate might decrease by an amount you and the lender agree upon.

Whether this trade-off works in your favor depends on your intended length of homeownership.

Life is unpredictable. Career changes, family growth, or simply a desire for a different environment can lead to a move sooner than anticipated.

If you sell or refinance your loan before reaching the "break-even point" – the moment your cumulative savings from lower payments equal the initial cost of the points – you'll end up in the red.

If your future in the home feels less than certain, that upfront investment in discount points becomes a risky bet.

The money you'd spend on discount points could serve more pressing needs. Perhaps you need a more robust emergency fund, or you have other investment opportunities you want to pursue.

FHA loans are attractive partly because they often require a smaller down payment. However, if you deplete a significant portion of your remaining savings to shave off a tiny bit of interest, you might leave yourself financially vulnerable for unexpected expenses.

The savings from a slightly lower interest rate might pale compared to the total loan cost, including the mandatory mortgage insurance. It depends on your long-term plans.

In such situations, prioritizing cash flow and minimizing immediate outlays often makes more sense.

The current interest rate environment plays a role in this decision. Are interest rates already relatively low at the time? In such cases, the potential savings you'll gain by purchasing discount points might be minimal.

- It could take a very long time for your reduced monthly payments to add up to the money you spent on the points.

- Conversely, in a high-interest-rate market, buying points might be a more compelling option for someone committed to staying in the home long-term.

- Does paying for discount points align with your short-term and long-term financial goals? Are you confident in your long-term plans for the property?

- How comfortable are you with parting with the cash upfront at closing time?

FHA Loan Articles

January 16, 2025Want to buy a home and thinking about getting an FHA loan? FHA loans are a great way to make homeownership happen, especially if you're a first-time buyer or don't have perfect credit. But you might wonder, "Can I get more than one FHA loan?"

The short answer is, it's tricky. The FHA itself doesn't say no automatically to having more than one loan. But there's a caveat. FHA loans are about helping you buy a place to live in – your main home base. Because of this, and a few other things, getting multiple FHA loans isn't easy.

January 15, 2025Buying a condo with an FHA loan is an option some don’t consider initially, but it’s worth adding to your list of potential property types. FHA loans for condo units traditionally require condo projects to be on or added to the FHA-approved list. Still, changes in policy over the years allow borrowers to apply for FHA loans on condo units in projects not on the list on a case-by-case basis.

December 30, 2024When applying for an FHA loan, lenders will consider more than just your credit scores and history. They also look at other factors affecting your risk profile and the interest rate they offer you.

One factor is occupancy type. For FHA loans, this is straightforward because these loans require owner occupancy. Investment properties aren't eligible. While conventional loans may have different rates for primary residences, second homes, and investment properties, this isn't a concern with FHA loans.

December 18, 2024Did holiday spending get the better of you? Are you looking for ways to recover your spending plan as you search for a new home?

The holidays are a whirlwind of festivities, family gatherings, and gift-giving. But amidst the cheer, it's easy to lose track of spending. If you're aiming to buy a home in the near future, those extra expenses can have a bigger impact than you might realize, especially if you're considering an FHA loan.

December 17, 2024The Federal Housing Administration provides mortgage insurance on loans made by FHA-approved lenders, making homeownership more attainable for those who might not qualify for conventional loans.

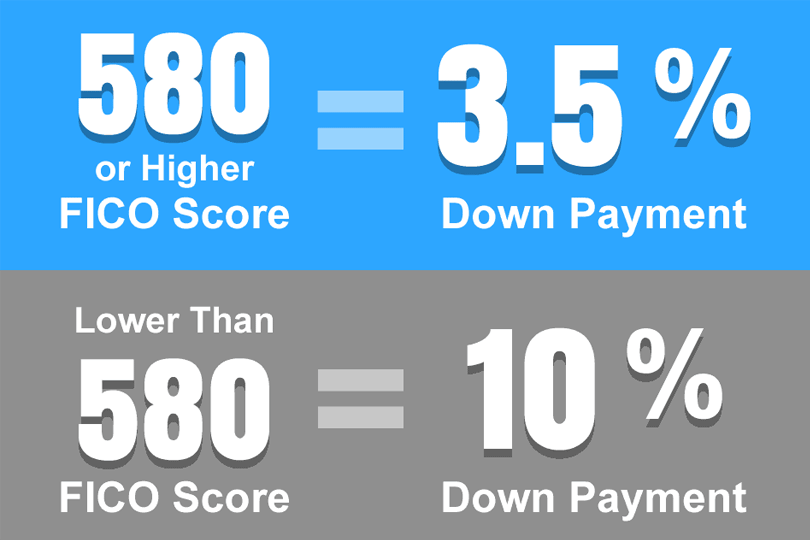

While financial factors like credit score and debt-to-income ratio are key to loan approval, other non-financial aspects can also cause a denial.