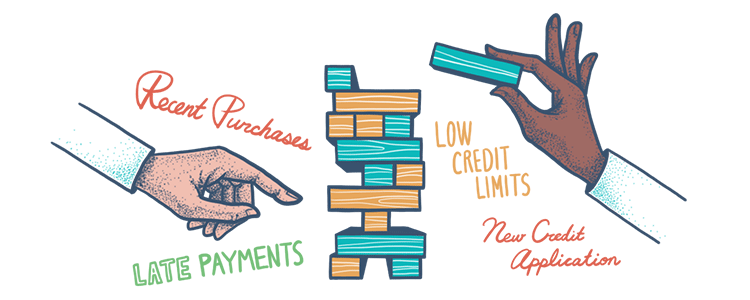

What Affects Credit Scores?

If you are about to apply for a home loan, it’s normal to be worried about your credit score and checking it often. You’re doing everything you can to secure a good interest rate, and a high credit score is essential for that.

We’ve all heard, from multiple sources, what is and isn’t good for your credit. Many well-meaning people might give you advice about the dos and don’ts to help you keep your scores up. But it’s likely that you’ve come across some misinformation along the way. Here are the facts!

Credit Score Considerations

AN EXPENSIVE PURCHASE

You might see your credit score drop after making a big purchase for which you use a large portion of your available credit limit. It surprises many credit card holders when the score drops even after they pay off the balance in full on their due date. This is because lenders see you using a large amount of your available credit and assume you are not managing your finances efficiently. The good news is that it's easy enough to recover those lost points by paying down the balance on time and holding off on other large credit card purchases.

PAYMENTS MORE THAN 30 DAYS LATE

Your payment history accounts for 35% of your FICO score, so it makes sense that a late payment can significantly lower your score. Any payments, whether they’re on your credit card or other loans, that are more than 30 days past due are reported to the credit bureaus and are then reflected in your credit score.

LOWERED CREDIT LIMITS

You may not always have control over this, but your credit score can take a hit when your available credit is lowered. Similar to when you make an expensive purchase, lowering your available credit on a credit card means the portion you utilize goes up, and your credit score goes down. In the case you’re your bank lowers your limit, a good way to avoid your credit score dropping is to avoid using more than 30% of the available credit line.

NEW CREDIT APPLICATION

An inquiry is added to your credit report any time you put in an application for credit, and this makes up 10% of your overall score. Inquiries stay on your credit report for two years, but are factored into your score for only one year.

Myths About Credit Scores

YOUR INCOME LEVEL AFFECTS YOUR SCORE. NOT TRUE!

Credit bureaus do not consider information about your job, salary when calculating your scores. Employer information may be listed on your credit report, but your actual income is not. When you apply for a loan, a lender may ask for your salary to determine how much you can afford to borrow, but your income does not impact your credit score.

CHECKING YOUR OWN CREDIT IS HARMFUL. NOT TRUE!

When a lender does a credit check, it’s considered a “hard” inquiry that affects your credit score. But if you’re curious about your own score, there are many reputable sources where you can get a “soft” credit check without it bringing down any points on your score.

PAYING OFF HIGH INTEREST RATE DEBT HURTS YOUR SCORE. NOT TRUE!

Just because you may have a high interest rate on your credit cards or loans doesn’t mean it’s going to affect your credit score and keep you from getting a low rate in the future. It’s true that the higher your credit score is, the lower interest rate you’ll get from a lender, but it doesn’t work the other way around.

BANK OVERDRAFTS ARE AS BAD AS LATE PAYMENTS. NOT TRUE!

Overdrawing your bank account can result in you having to pay fees, and that can get expensive. But this doesn’t affect your credit score the way a late payment does. As long as you clear up the overdraft and pay the penalty fees before your account is sent to a collection agency, your score does not a hit. However, once your account goes to collections, it is considered an unpaid debt, and that can bring down your score.

FHA Loan Articles

August 10, 2023FHA loans have specific rules and requirements for borrowers who have filed for bankruptcy. The guidelines can change over time, so it's essential to consult with a qualified lender or FHA-approved counselor for the most up-to-date information.

August 3, 2023FHA loans are primarily designed to help individuals and families purchase homes for use as their primary residences. Rules for these loans generally discourage their use for investment properties or rentals. However, there are exceptions that come with strict rules.

July 29, 2023One crucial aspect of FHA loans that borrowers need to understand thoroughly is debt ratios. In this article, we look at how they can impact your ability to secure financing for your dream home. Debt ratios help lenders understand a borrower's creditworthiness and any risks associated with the loan.

July 21, 2023Investing in a multi-unit property can be an excellent way to build wealth through rental income and property appreciation. FHA multi-unit property loans make this opportunity more accessible to a broader range of individuals. You must occupy a unit as your primary residence within 60 days of closing the loan.

July 15, 2023To qualify for an FHA loan, you must meet certain employment requirements. In this article, we'll dig into the FHA loan employment requirements so that you can understand what's needed to get approved for this type of mortgage.

July 7, 2023Manufactured homes, sometimes referred to as mobile or modular homes, are factory-built residences designed to meet or exceed national building codes set HUD. They offer cost savings and energy efficiency, making them an attractive housing option for many Americans.